The decedent’s daughter-in-law and grandchildren filed an action seeking to set aside the decedent’s 2016 will that disinherited them, and to admit a prior will and codicil. They claimed that the decedent lacked testamentary capacity to make the 2016 will, and that the decedent’s daughter had exercised undue influence to cause the decedent to disinherit.. read more →

An 82-year old widow living on Social Security benefits borrowed over $400,000 and signed mortgage documents calling for the loan to be repaid in monthly installments over 30 years. The bank brought a foreclosure action, claiming that the mortgage was a conventional mortgage and that the widow had defaulted on the payments. The widow claimed.. read more →

The New Jersey legislature has passed a medical aid in dying bill which Governor Murphy has indicated he will sign. The new law states that [New Jersey] affirms the right of a qualified terminally ill patient, protected by appropriate safeguards, to obtain medication that the patient may choose to self-administer in order to bring about.. read more →

Executors of the estate filed an Order to Show Cause requesting approval of the estate’s final accounting in a summary manner. The Order to Show Cause was entered and a return date was scheduled. Opposing family members filed a responsive pleading, in which they accused the executors of withholding financial information and commingling estate assets… read more →

Congressman John Garamendi, D-CA, recently introduced the Fair COLA for Seniors Act, H.R. 1553, to end inadequate retirement cost-of-living adjustments (COLAs) that don’t account for the effects of inflation on older Americans. H.R. 1553 would require a switch to the Consumer Price Index for the Elderly (CPI-E) from the Consumer Price Index for Urban Wage.. read more →

Shortly after their father’s death, plaintiff (one of the decedent’s sons) filed a caveat against the estate, based on allegations of undue influence and payments made to his siblings prior to their father’s death. After his brother filed a complaint in the Superior Court, Probate Part to admit the father’s will to probate, plaintiff voluntarily.. read more →

Free Seminar “Planning For The Catastrophic Costs Of Long-Term Care” Wednesday, April 3, 2019 4:00 PM Free Seminar Law Office of Vanarelli & Li, LLC 242 St. Paul Street Westfield, NJ 07090 Health care issues increase as we age, and become more complex. Please join Donald D. Vanarelli, Esq., Certified Elder Law.. read more →

Wayne Lippincott’s widow Anne probated a will dated two days before his death in 2015. The couple had been married 28 years, and each had grown children from prior marriages. Wayne’s children and grandchildren challenged the will, claiming undue influence, lack of capacity, forgery, and failure to comply with the formalities of execution. They sought.. read more →

One-third of Medicare beneficiaries experienced harm or adverse events during a nursing facility stay, and about 60% of those instances were preventable, according to reports from the Inspector General of the Department of Health and Human Resources. A new 60-page report from the Centers for Medicare & Medicaid Services (CMS) delves into the steps nursing homes.. read more →

ElderLawAnswers.com is a web site designed for seniors, their families, and attorneys with an interest in elder law issues ElderLawAnswers.com serves two distinct audiences: the public (namely seniors and their families), and elder law attorneys. The site delivers quality information about important issues facing seniors and provides seniors with referrals to qualified elder law attorneys.. read more →

Top Rated New Jersey Lawyers In 2019 Donald D. Vanarelli has been selected by the New Jersey Law Journal as a Top Rated New Jersey Lawyer in 2019. Mr. Vanarelli, and the other attorneys featured in the list of Top Rated NJ Lawyers, have all achieved the peer reviewed rating of “AV Preeminent” by Martindale-Hubbell,.. read more →

In 1990, Irving Helsel established the “The 1990 Irving Helsel Family Trust” (the Trust), which included the “Irving Helsel Family Trust” (Family Trust) and the “Irving Helsel Exempt Trust” (Exempt Trust). He designated his children, Frederic and Bonnie, as beneficiaries of the Family Trust. The Family Trust allowed for distribution of the principal to Bonnie.. read more →

The Social Security Administration (SSA) is proposing regulations which may make it more difficult for people who don’t speak English to qualify for disability benefits. Under planned regulations released February 01, 2019, the SSA would no longer consider a person’s “inability to communicate in English” when reviewing applications, both for Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) benefits. The.. read more →

The Consumer Financial Protection Bureau (CFPB) has released a report on financial exploitation of the elderly. The report compiles information from Suspicious Activity Reports (SARs) submitted by banks, credit unions, casinos, and other financial services providers. Based upon the SARs, financial institutions have reported that financial exploitation of older adults by scammers, family members, caregivers,.. read more →

Judgment Invalidating Incompetent Person’s Last Will And Testament While He Was Still Alive Affirmed In Pre-Death Will Contest

Harry and Jean Sable were the parents of three adult sons, Michael, Don and Barry. Harry and two partners owned a building in Philadelphia where Harry conducted Harry Sable, Inc., a jewelry business. Harry and Jean had wills prepared in 1994 and 1998 with similar provisions. Harry left his entire estate to Jean if she.. read more →

John E. Travers, Jr. died unexpectedly in 2017 at the age of twenty-two. He was unmarried and died without any children, without a will, and without any written directive regarding his funeral or the disposition of his remains. Decedent’s parents, who are divorced, differed on how their son’s remains should be disposed of, and each.. read more →

This blog post discusses recent changes in how the Social Security Administration (SSA) evaluates disbursements from trusts, particularly special needs trusts. SSA regulations are published by the agency and compiled in the Program Operations Manual System (POMS). The POMS is a primary source of information used by Social Security employees to process claims for Social.. read more →

The decedent, Kathryn Parker Blair, had executed a will bequeathing her estate to her siblings and directing that, if any of her siblings predeceased her, that sibling’s share would pass to his or her surviving children. After her brother died, the decedent executed a new will omitting the brother’s child (“petitioner”) as a beneficiary. The.. read more →

In a recent decision, the U.S. Court of Appeals for the Federal Circuit ruled that the presumption of service-connection for certain diseases suffered by Vietnam War era veterans applied to so-called “blue water” veterans – those who served on ships in seas off the coast of Vietnam, but did not set foot on land. Procopio.. read more →

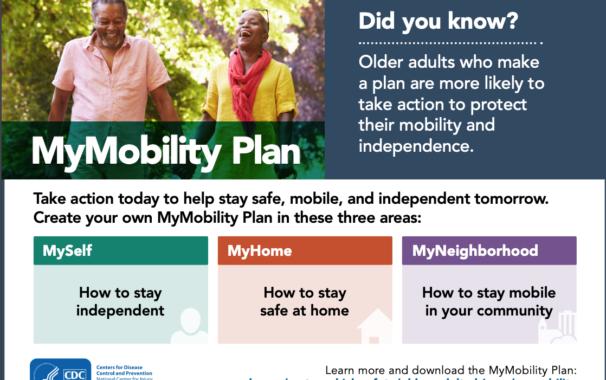

MyMobility Plan, a new tool from the Centers for Disease Control and Prevention, helps older adults plan for future mobility and independence when driving a car is no longer an option. The Centers for Disease Control and Prevention (CDC) developed the MyMobility Plan app to help older adults take action to maintain optimal mobility, avoid falls, and.. read more →

Social Security Disability Insurance (SSDI) is one of the major federal programs that provides monetary assistance to people with disabilities. Supplemental Security Income (SSI) is a federal program that helps people with disabilities and very low income and assets pay for food and shelter. SSDI is often confused with SSI. Although both programs pay benefits to.. read more →

Is your medical item or service covered by Medicare Part A and/or Part B? Now there’s a quick way to check! Medicare’s free “What’s Covered” app delivers accurate cost and coverage information right on your smartphone. Now you can quickly see whether Medicare covers your service in the doctor’s office, the hospital, or anywhere else.. read more →

(The following blog post is adapted from a summary of this case on the ElderLawAnswers website. Mr. Vanarelli is a founding member of ElderLawAnswers.) A New York appeals court ruled that a lower court erred in ordering the trustee of a special needs trust (SNT) to personally pay various fees and costs associated with the.. read more →

Nursing Home Resident’s Son Who Filed A Medicaid Application Which Was Denied Did Not Breach Admissions Agreement

A New Jersey appeals court held that a nursing home is not entitled to summary judgment in a case alleging breach of the admissions agreement against a resident’s son based solely on the fact that Medicaid denied the resident’s application due to excess resources. Meridian Nursing and Rehabilitation Inc. v. Skwara (N.J. Super. Ct., App. Div., No… read more →

The decedent was an elderly man with no immediate family. His Last Will and Testament left his estate to a cousin, several charities and individuals, and to two Valley National Bank employees, including the defendant. One of the bank employees refused the bequest as unethical, based on the bank’s Employee Code of Conduct. The defendant.. read more →

M.K. resided in an assisted living facility (ALF) since 2006. She applied for Medicaid benefits and was approved as of May 1, 2015. Due to the income limitations of the Medicaid program, M.K. deposited all of her income in a Qualified Income Trust, or QIT. By doing so, income deposited in the QIT was not.. read more →

Veterans and their families should be aware of the various benefits that may be available to them through the United States Department of Veterans Affairs (“VA”). GENERAL HEALTH SERVICES AND OTHER PROGRAMS The VA offers many special programs for veterans, among which are the following: Benefits for returning veterans: Health care for 5 years following.. read more →

The decedent’s wife predeceased him. Thereafter, in 2009 the decedent executed a new will leaving his estate to his wife’s niece (the defendant). At the defendant’s suggestion, the decedent also executed a revocable living trust. Shortly thereafter, he became concerned about losing control of his assets, and he retained a new lawyer to draft a.. read more →

Anthony F. Cordasco and his wife, Louise, were living in a condominium when Louise became ill in late 2012. The Cordascos decided to sell the condominium and move in with their daughter, Roseann Altiero, who agreed to care for Louise. Anthony and Louise signed a listing agreement in January 2013 and placed the condominium on.. read more →

What is Elder Law? Elder Law is broad legal practice area involving the complex problems of older and disabled persons. The clients served by Elder Law attorneys can be among society’s most vulnerable people, often seeking help when they are most in need of wise counsel and advice. Elder Law attorneys deal “holistically” with their.. read more →

A Massachusetts trial court ruled that a Medicaid hearing examiner should have accepted evidence that a Medicaid applicant’s transfer of her house fell under the caretaker child exception and that the applicant’s other transfers were not made in order to qualify for Medicaid. Coko v. Daniel Tsai, Director of the Office of Medicaid (Essex Sup. Ct… read more →

Karen Horbatt was Theodore A. Kaczmarek’s niece by marriage. After Karen’s aunt died, Theodore executed a will in 2009 leaving Karen his entire estate, valued at over four million dollars. At the same time, Theodore executed a revocable living trust agreement, designating Karen as the sole trustee. Both documents were drafted by a lawyer procured.. read more →

Shared with permission of Veterans Information Services, Inc. and the Creators of VisPro. Copyright: Veterans Information Services, Inc. Website: www.info4vets.com For additional information concerning VA compensation and pension benefits, visit: VA Compensation and Pension Benefits Vanarelli & Li, LLC website: Home read more →

After L.K.’s representative filed for Medicaid benefits, Medicaid sent a checklist of documents to be provided within thirty days, including American Funds account statements. Five months later, Medicaid sent a second letter, again seeking the same documents, again within thirty days. After that deadline passed, L.K’s representative sent some of the account statements and advised.. read more →

The decedent was estranged from her daughter Cheryl, the defendant, for almost 25 years, but they reconciled shortly before her death, when the decedent was ill. In 1996, the decedent and her husband had executed wills and a trust, excluding Cheryl from their estates. In 2006, the decedent and her husband consulted with a special.. read more →

Search

Call Us Today

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media