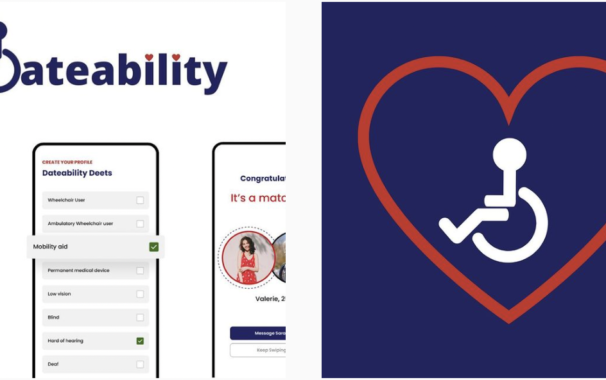

Recently, I read an interesting article in the Washington Post about Dateability, a dating app designed for disabled and chronically ill people. Dateability was launched this year, on October 21st. It carries the slogan “Making love accessible.” Some people with disabilities feel they are discriminated against by other users on dating platforms, and not seen.. read more →

This matter arose from the imposition of a transfer penalty on Petitioner’s receipt of Medicaid benefits. Beginning in 2018, Petitioner resided with her son, R. R., and R. R. ‘s wife. Petitioner previously resided in her own home. On November 1, 2018, Petitioner and R. R. executed a “Room Rental Agreement, ” wherein Petitioner agreed to.. read more →

In this case, C.L., a resident of a nursing home, applied for Medicaid benefits. The state’s Medicaid agency, the Division of Medical Assistance and Health Services (DMAHS), denied her application. DMAHS determined an annuity C.L. purchased, which she understood to be irrevocable, was instead found to be revocable by the agency and counted as a.. read more →

10 Costly Mistakes to Avoid When Planning for a Loved One with Special Needs 1. Doing nothing. The most popular estate plan in the Unites States is doing nothing. While not a good idea for anyone, it is particularly troubling when there is a loved one with special needs. If someone does nothing and then.. read more →

A.V. suffered from Alzheimer’s disease and dementia. In January 2021, A.V. moved into a skilled nursing facility. That April, she filed her first application for Medicaid benefits, seeking a community spouse resource allowance for her husband, J.V. In June 2021, the Cumberland County Board of Social Services (CCBSS) denied the claim, advising A.V. and J.V… read more →

Chen Li, Esq. (http://VanarelliLaw.com/) will present on Trusts and Trust Taxation Issues impacting the New Jersey Probate and Trust Administration Process in an online seminar given by the National Business Institute (NBI) on December 15, 2022. Ms. Li will discuss aspects of the probate process and trust administration in New Jersey. Specifically, Ms. Li will.. read more →

In this case, an administrative law judge held that a Medicaid applicant’s transfer of her home to her adult child who lived with and cared for her for many years was entitled to Medicaid benefits under the “caretaker child” exemption to the transfer of assets rules even though the child worked part-time outside the home… read more →

In a decision that has been approved for publication, the New Jersey Superior Court, Appellate Division, affirmed the dismissal of a lawsuit challenging New Jersey’s Medical Aid in Dying for the Terminally Ill Act (the “Act”). The lawsuit, which was brought by a terminally ill resident, a physician, and a pharmacist, attempted to enjoin and.. read more →

Six years ago, New Jersey Family launched Best NJ Lawyers for Families campaign. The website asks parents about the lawyers who’ve made a difference in their family’s lives at the most stressful of times. According to the website, the nominations by parents result in a list of professionals who’ve “gone above and beyond” to advocate for their.. read more →

If a person declared to be incapacitated wishes to execute a Last Will and Testament, there a judgment must first be entered by a court declaring that the proposed testator has regained capacity to do so. See N.J.S.A. 3B:12-27; In re Estate of Frisch, 250 N.J. Super. 438 (Law Div. Probate Part 1991); In re.. read more →

If you are injured due to another person’s negligence and receive Medicaid benefits to pay for care, New Jersey (as well as other states) always had a legal right to recover the funds the state spent on your medical expenses from a personal injury settlement or award. Once the state was reimbursed for past medical.. read more →

Chen Li, Esq. (http://VanarelliLaw.com/) will present on the “New Jersey Probate Process and Executor Duties: Master Checklist with Deadlines” given by the National Business Institute on August 17, 2022 via online seminar. Ms. Li will discuss the probate process in New Jersey including an overview of the duties required of an estate executor. She will.. read more →

The asset limit for Supplemental Security Income (SSI) has been stuck at $2,000 since 1984. That’s equivalent to more than $5,600 today. So, in effect, it has been cut by almost two thirds. There is now a bill in congress, the SSI Savings Penalty Elimination Act that would raise the asset limit to $10,000 for.. read more →

In this case, the New Jersey Superior Court, Appellate Division, reversed a final decision of the state Medicaid agency imposing a 203-day period of disqualification for Medicaid benefits based upon the applicant’s alleged transfer of assets for less than fair market value within the five-year look-back period before the applicant entered a nursing home. J.F… read more →

Court Dismisses Daughter’s Lawsuit Against Mother’s Estate Lawyer

Before she died, Dorothy Dreher (“Dorothy”) had her attorney prepare a power of attorney naming her son David as her agent. Dorothy later had that same attorney prepare a Last Will and Testament, which favored her son David over her daughter Rebecca. Rebecca became concerned about David’s actions under Dorothy’s power of attorney, and had.. read more →

We are pleased to announce that Donald D. Vanarelli was named to the New Jersey Super Lawyer’s list in Elder Law in 2022. Out of 85,000 attorneys licensed to practice law in New Jersey, and the numerous attorneys who practice Elder Law in our state, Mr. Vanarelli is one of only 32 attorneys to be.. read more →

It is with great pride and gratitude for her years of effort and loyalty to the firm that we welcome Chen Li, Esq. as a named partner of the firm, which has changed its name to Vanarelli & Li, LLC. Chen Li brings 20 years of legal experience in the areas of Medicaid and public.. read more →

Every day the lives of older adults are profoundly and negatively impacted in both the criminal and civil justice systems based on mistaken assumptions and inadequate assessments of their capacity to make decisions for themselves. In order to raise greater awareness of these issues and improve how elder justice professionals approach these issues, the Department.. read more →

After their father’s death, one of the decedent’s sons filed litigation against his siblings in their capacities as co-executors of the estate. The plaintiff did not challenge the validity of the will; he sought to compel an accounting of the estate. In response to plaintiff’s lawsuit,.. read more →

News Alert from the Centers for Medicare & Medicaid Services website: Medicare does not currently pay for over-the-counter COVID-19 tests. However, as part of the ongoing efforts to expand Americans’ access to free testing, Medicare recipients will be able to get over-the-counter COVID-19 tests at no cost starting in early spring. Under the new initiative,.. read more →

Top Ten Most Popular Blog Posts on the VanarelliLaw Website in 2021

Listed below are the top ten (10) posts on the Vanarelli Law Office blog and website articles with the highest readership in 2021, as measured by the number of “unique page views” of each blog post. The title of each article is hyperlinked to the original posting on the blog so that each article is.. read more →

On January 14, 2022, the Assistant Secretary for Preparedness and Response, United States Department of Health and Human Services, issued the following Renewal of Determination That A Public Health Emergency Exists: U.S. Department of Health & Human Services As a result of the continued consequences of the Coronavirus Disease 2019 (COVID-19) pandemic, on this date.. read more →

The maximum amount that can be contributed each year to an ABLE account for a person with disabilities rose $1,000 to $16,000 on January 1, 2022. The figure, which is tied to the inflation-adjusted value of the IRS’s gift tax exclusion, had been stuck at $15,000 since 2018. Meanwhile, all but four states now offer ABLE programs. Congress.. read more →

2022 Elder Law Fact Sheet

Every year we release the key dollar amounts that are frequently used in elder law, estate administration and special needs trust planning, including Medicaid figures, Medicare premiums, Social Security Disability and Supplemental Security Income. Be sure to check back often, as we will add any information that has not yet been released and update the.. read more →

Being able to make health care decisions for ourselves is very important, but what happens if you become incapacitated and are unable to voice an opinion concerning your medical care? If you don’t have a health care proxy or guardian in place, state law chooses who can make those decisions. A few states, such as.. read more →

Donald D. Vanarelli, Esq. to Present on “End-of-Life” Issues at the 2021 Elder Law College–Second Semester

2021 Elder Law College–Second Semester Format/Skill Level: Webinar Location: Online Date: December 1, 2021 Time: 9:00 AM – 4:00 PM ET Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 2021 Elder Law College–Second Semester given by the New Jersey Institute for Continuing Legal Education on December 1, 2021 via ZOOM videoconference webinar. Mr. Vanarelli.. read more →

On November 18, 2021, the New Jersey Supreme Court entered an Order addressing whether proceedings in state courts should be conducted in person or virtually as the COVID-19 pandemic ends. In doing so, the Supreme Court stated that it tried to balance “the reduced time and cost associated with virtual proceedings” with the benefits of.. read more →

Today, the IRS announced that the annual gift exclusion will rise to $16,000 for calendar year 2022. The amount an individual can gift to any person without filing a gift tax return has remained at $15,000 since 2018. In addition, the basic estate tax exclusion amount for the estates of decedents dying during calendar year.. read more →

Recently, CMS Issued New Guidance for Unrestricted Visitation in Nursing Homes During the COVID-19 Public Health Emergency Nursing homes have been severely impacted by COVID-19, with outbreaks causing high rates of infection and death. In March 2020, the Centers for Medicare & Medicaid Services (CMS) issued a memorandum providing guidance to facilities on restricting visitation.. read more →

This lawsuit was actively litigated for nearly a decade. In this case, a sister filed a lawsuit against her brother regarding the Last Will and Testament of their father. The parties’ father executed a will in 2012 providing that his son would receive eighty percent of the estate, his daughter would receive ten percent, and.. read more →

Long-term care comes at a tremendous financial price, especially around-the-clock nursing home care. The cost of a private room in a nursing home in New Jersey is at least $12,000 per month, and may be more. Most people end up paying for long-term care and/or nursing home care out of their savings until they spend.. read more →

L.C. and his spouse R.S. sold their marital residence, and gave the proceeds of sale and other cash gifts to their daughter V.R. and her husband I.R. The total amount gifted was $435,000. V.R. and I.R. used the gifted assets to purchase a home. L.C. and R.S. lived at this home with V.R. and I.R… read more →

C.H., a resident of a long-term care facility, filed an application for nursing home Medicaid benefits. The Medicaid agency requested additional financial documentation from petitioner and petitioner’s designated authorized representative (DAR). The applicant’s DAR experienced repeated difficulties in obtaining the financial information requested by Medicaid. During those efforts, the DAR and the Medicaid caseworker exchanged.. read more →

Ralph Sandor died on January 20, 2018, at the age of 107. The Court appointed an Administrator Pendente Lite of the decedent’s estate (the “Administrator”). The Administrator filed an action seeking to set-aside gifts made by decedent’s grand-nephew, Anthony Russo, Jr. (“Russo”), by and through a power of attorney. The Administrator alleged that the transfers.. read more →

New Jersey appeals court affirmed denial of Medicaid application for failure to verify recurring bank transactions on applicant’s bank statements even though the transactions may have been part of a scam. G.M. v. Division of Medical Assistance and Health Services (N.J. Super. Ct., App. Div., No. A-0433-19, June 16, 2021). G.M. was eighty-three years old, suffered.. read more →

Search

Call Us Today

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media