In 2009, Petitioner executed a power of attorney (POA) in favor of her daughter, Vera. Ten years later, petitioner became a nursing home resident because she suffered from dementia and was no longer capable of managing her affairs. In January 2019, a social worker at the facility filed an initial Medicaid application on petitioner’s behalf… read more →

Court Dismisses Daughter’s Lawsuit Against Mother’s Estate Lawyer

Before she died, Dorothy Dreher (“Dorothy”) had her attorney prepare a power of attorney naming her son David as her agent. Dorothy later had that same attorney prepare a Last Will and Testament, which favored her son David over her daughter Rebecca. Rebecca became concerned about David’s actions under Dorothy’s power of attorney, and had.. read more →

Ralph Sandor died on January 20, 2018, at the age of 107. The Court appointed an Administrator Pendente Lite of the decedent’s estate (the “Administrator”). The Administrator filed an action seeking to set-aside gifts made by decedent’s grand-nephew, Anthony Russo, Jr. (“Russo”), by and through a power of attorney. The Administrator alleged that the transfers.. read more →

New Jersey appeals court affirmed denial of Medicaid application for failure to verify recurring bank transactions on applicant’s bank statements even though the transactions may have been part of a scam. G.M. v. Division of Medical Assistance and Health Services (N.J. Super. Ct., App. Div., No. A-0433-19, June 16, 2021). G.M. was eighty-three years old, suffered.. read more →

Guardianships and Medicaid Planning – Video 1 On June 15, 2021, I participated in the 2021 Elder Law College given by the New Jersey Institute for Continuing Legal Education via ZOOM videoconference webinar. I presented a paper and discussed Medicaid planning in the contest of guardianships in New Jersey. Medicaid planning involves the strategic transfer.. read more →

(The BiFocal e-newsletter is a publication of the ABA Commission on Law and Aging. In a recent BiFocal e-newsletter, the ABA Commission published the following guidance on defensive practices that may be used to prevent misuse of a power of attorney, such as careful selection of agents, drafting in oversight and accounting, and limiting powers… read more →

October 18-25 is National Estate Planning Awareness Week. National Estate Planning Awareness Week was adopted in 2008 to help the public understand what estate planning is and why it is such a vital component of financial wellness. The House of Representatives, in House Resolution 1499, named the third week in October of each year as.. read more →

Judgment Against Adult Child Who Served As Her Mother’s Power Of Attorney And Executrix Affirmed On Appeal

Christine D. Cenaffra (decedent) had six children, two of whom were the parties in this lawsuit. Diane Cenaffra was the plaintiff, and her sister Patricia Stollenmaier was the defendant. Decedent died in 2015. Her Last Will and Testament named defendant as the executrix. Defendant also was her mother’s power of attorney (POA). Decedent resided with.. read more →

The New Jersey Director of Medicaid approved the transfer of an applicant’s home to a “caregiver child” who worked full-time because the applicant qualified medically for comprehensive home-based services under the Medicaid program. A.H. v. Bergen County Board of Social Services, OAL DKT. NO. HMA 09215-19 (June 26, 2020) When she was 92 years old,.. read more →

An Ohio appeals court dismissed a nursing home’s lawsuit to recover a resident’s unpaid fees from his son who signed an admission agreement as his father’s agent under a power of attorney. Village at the Greene v. Smith (Ohio Ct. App., 2d, No. 28762, August 14, 2020). On June 22, 2018, Robert Smith (“the father”) granted.. read more →

Millions of Americans manage money or property for a loved one who’s unable to pay bills or make financial decisions. To help financial caregivers, the Consumer Financial Protection Bureau, or the CFPB, worked closely with the American Bar Association Commission on Law and Aging to prepare four (4) guides: Help for agents under a power.. read more →

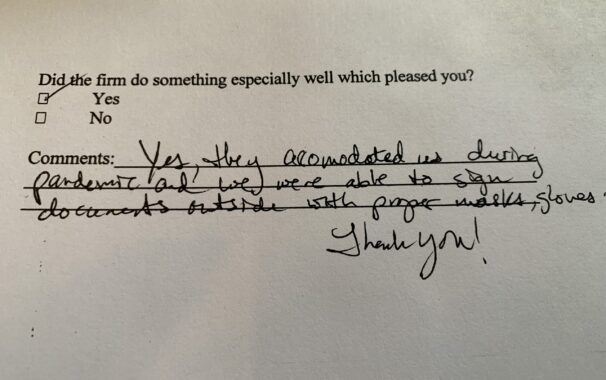

Question: How to ensure that clients have an opportunity to sign their Last Wills and Testaments, Powers of Attorneys, Special Needs Trusts, Physician Orders for Life-Sustaining Treatment (POLST) forms, Advance Medical Directives and the myriad of other estate documents we typically prepare for clients during a coronavirus pandemic when social distancing is mandatory? Answer: Conduct.. read more →

You may need to reevaluate some elements of your estate plan in light of the coronavirus pandemic. There are unique aspects of this crisis that your current estate planning documents may not be suited to handle. The language in some estate planning documents that is fine under normal conditions may cause additional problems for you.. read more →

As we find ourselves spending a lot more time at home, there are many opinions about how to fill the day while maintaining a healthy balance of activities. Most recommend a mixture of productivity and what some might refer to as “self-care,” which can take many forms. It can include eating right, exercising, enjoying a.. read more →

G.M., a 73 year old stroke victim, was diagnosed with Alzheimer’s disease, vascular dementia, schizoaffective and bipolar disorders. After G.M. filed a Medicaid application, the Atlantic County Board of Social Services (Board) notified G.M. that his application was denied because he did not provide necessary information. Several months later, G.M.’s designated authorized representative (DAR) submitted.. read more →

The decedent, Felix Fornaro, had two children: his daughter Linda (plaintiff) and his son Carmine (defendant). In December 2011, the decedent executed a Last Will and Testament leaving 80% of his estate Carmine and 10% to Linda, with the remainder passing to his grandchildren. A year later, Mr. Fornaro died. Linda challenged the 2011 will… read more →

Lawsuit By Nursing Home Against Daughter of Resident Who Transferred Money to Herself Dismissed

New Jersey appeals court held that a nursing home does not have standing to bring a lawsuit against the daughter/power of attorney of a resident who transferred the resident’s money to herself, causing a Medicaid penalty period. Future Care Consultants v. M.D. (N.J. Super. Ct., App. Div., No. A-4565-17T1, July 5, 2019). M.D. cared for her.. read more →

A power of attorney does not have to return money she took from her now deceased principal because the power of attorney removed the money for Medicaid planning purposes. In re Estate of Hirnyk (Pa. Super. Ct., No. 84 WDA 2018, April 16, 2019). Maria Hirnyk, a Ukrainian immigrant, did not drive and required assistance with.. read more →

Judgment Invalidating Incompetent Person’s Last Will And Testament While He Was Still Alive Affirmed In Pre-Death Will Contest

Harry and Jean Sable were the parents of three adult sons, Michael, Don and Barry. Harry and two partners owned a building in Philadelphia where Harry conducted Harry Sable, Inc., a jewelry business. Harry and Jean had wills prepared in 1994 and 1998 with similar provisions. Harry left his entire estate to Jean if she.. read more →

B.S. was ninety-two years old and residing in a nursing home when she applied to the Monmouth County Division of Social Services, the County Welfare Board (CWB), for Medicaid benefits. In response to the application, the CWB inquired about two 2010 bank withdrawals from petitioner’s accounts, one for $29,955.79 and the other for $37,085.47. Petitioner.. read more →

The Appellate Division of the Superior Court of New Jersey dismissed this appeal, refusing to remand the case for administrative hearings that were never held because the applicant failed to preserve her right to those hearings. B.M. v. Division of Medical Assistance and Health Services, Docket No. A-3546-16T3 (App. Div., August 29, 2018) Esther Schulgasser.. read more →

Love And Care Provided By Nephew Did Not Justify His Failure To Notify Any Beneficiaries Of The Existence Of Aunt’s Will

In 1998, Joan McFadden executed two powers of attorney (POAs) and a Living Will-Durable Health Care Power appointing John McFadden, her nephew, as her agent and attorney in fact, and Mary Sexton, her niece and John’s sister, as her alternative agent and attorney-in-fact. The two POAs stated that they would become effective upon the following.. read more →

A New Jersey appeals court ruled that a Medicaid applicant who began paying her daughter after the daughter provided two years of free caregiving did not rebut the presumption that a transfer of assets to a relative who previously provided services for free is an uncompensated transfer of assets for Medicaid purposes. E.B. v. Division of.. read more →

From June 21, 2018 edition of The Wichita Eagle: A Kansas man was found guilty of a felony after using his mom’s money for personal purchases instead of her nursing home care, officials said. Bruce J. Colle, 61, of Hutchinson, was found guilty Wednesday of one felony county of mistreatment of an elder person, Kansas.. read more →

A.S.’s nephew and power of attorney designated Senior Planning Services (“SPS”) as A.S.’s authorized representative for establishing Medicaid eligibility. In SPS filed a Medicaid application, which was denied for excess resources on December 10, 2012. After SPS filed a request for a fair hearing but before the fair hearing was scheduled, A.S. died, and SPS.. read more →

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media