Top Ten Most Popular Blog Posts on the VanarelliLaw Website in 2021

Listed below are the top ten (10) posts on the Vanarelli Law Office blog and website articles with the highest readership in 2021, as measured by the number of “unique page views” of each blog post. The title of each article is hyperlinked to the original posting on the blog so that each article is.. read more →

IRS Issues Final Regulations For Achieving A Better Life Experience (ABLE) Accounts

The Internal Revenue Service issued final regulations this month providing details about how Achieving a Better Life Experience (ABLE) accounts should operate. ABLE accounts are designed to help people with disabilities and their families save up to $100,000 without risking eligibility for Supplemental Security Income (SSI) and other government benefits based on financial need. Medicaid can.. read more →

October 18-25 is National Estate Planning Awareness Week. National Estate Planning Awareness Week was adopted in 2008 to help the public understand what estate planning is and why it is such a vital component of financial wellness. The House of Representatives, in House Resolution 1499, named the third week in October of each year as.. read more →

Millions of Americans manage money or property for a loved one who’s unable to pay bills or make financial decisions. To help financial caregivers, the Consumer Financial Protection Bureau, or the CFPB, worked closely with the American Bar Association Commission on Law and Aging to prepare four (4) consumer guides: Help for agents under a.. read more →

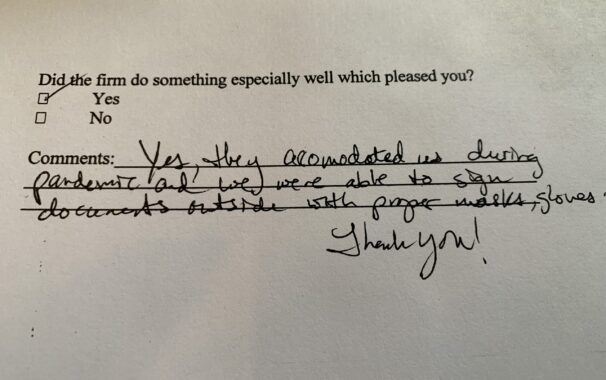

Question: How to ensure that clients have an opportunity to sign their Last Wills and Testaments, Powers of Attorneys, Special Needs Trusts, Physician Orders for Life-Sustaining Treatment (POLST) forms, Advance Medical Directives and the myriad of other estate documents we typically prepare for clients during a coronavirus pandemic when social distancing is mandatory? Answer: Conduct.. read more →

As we find ourselves spending a lot more time at home, there are many opinions about how to fill the day while maintaining a healthy balance of activities. Most recommend a mixture of productivity and what some might refer to as “self-care,” which can take many forms. It can include eating right, exercising, enjoying a.. read more →

In December 2019, the U.S. Congress enacted into law the “Setting Every Community Up for Retirement Enhancement Act of 2019,” also known as the SECURE Act, as part of a year-end spending bill. The SECURE Act makes major changes to retirement plan rules, including inherited plans. The effective date for the new law is January.. read more →

Revocable trusts are an effective way to avoid probate and provide for asset management in the event of incapacity. In addition, revocable trusts–sometimes called “living” trusts–are incredibly flexible and can achieve many other goals, including tax, long-term care, and asset-protection planning. A trust is a legal arrangement through which one person holds legal title to property.. read more →

In 1995, Frances and Larnie Shaw, prepared a number of estate planning documents. One of the documents, a testamentary trust created by Frances, was known as “Credit Shelter Trust.” Larnie and Janice, one of the Shaws’ three daughters, were designated as co-trustees of the Credit Shelter Trust. The Shaws’ other daughters were Carolyn and Shirley… read more →

On November 5, 2019, I presented at the Fall Meeting of the Essex/Hudson/Union Chapter of the New Jersey Association of Public Accountants held at Kean University in Hillside, New Jersey. I presented an overview of the various types of revocable and irrevocable trusts used by estate planners and by elder law and special needs planning.. read more →

Donald D. Vanarelli, Esq. to Discuss Social Security and Medicare Issues at 21st Annual Elder and Disability Law Symposium

21st Annual Elder and Disability Law Symposium Presented in cooperation with the NJSBA Elder and Disability Law Section Format/Skill Level: Meeting Location: APA Hotel Woodbridge, 120 S. Wood Ave Iselin, NJ 08830 Date: December 18, 2019 Time: 9:00 AM – 5:00 PM Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 21st Annual Elder and Disability.. read more →

Moses Ratowsky created an irrevocable trust for the benefit of his grandson, Daniel Schreiber (hereinafter the grandson). Petitioners, the co-trustees of the irrevocable trust, filed an application to appoint the principal of the trust to a new special needs trust that would allow the grandson to retain the benefits of the original trust while preserving.. read more →

In 1990, Irving Helsel established the “The 1990 Irving Helsel Family Trust” (the Trust), which included the “Irving Helsel Family Trust” (Family Trust) and the “Irving Helsel Exempt Trust” (Exempt Trust). He designated his children, Frederic and Bonnie, as beneficiaries of the Family Trust. The Family Trust allowed for distribution of the principal to Bonnie.. read more →

This blog post discusses recent changes in how the Social Security Administration (SSA) evaluates disbursements from trusts, particularly special needs trusts. SSA regulations are published by the agency and compiled in the Program Operations Manual System (POMS). The POMS is a primary source of information used by Social Security employees to process claims for Social.. read more →

The decedent was estranged from her daughter Cheryl, the defendant, for almost 25 years, but they reconciled shortly before her death, when the decedent was ill. In 1996, the decedent and her husband had executed wills and a trust, excluding Cheryl from their estates. In 2006, the decedent and her husband consulted with a special.. read more →

Following the decedent’s death, Bank of America became successor trustee of four trusts created by the decedent. In 2016, the decedent’s children filed complaints against the bank, seeking accountings for the trusts. The bank submitted accountings and a complaint seeking court approval of the accountings. The decedent’s children then filed another complaint, seeking another accounting.. read more →

The decedent was survived by her incapacitated son, for whom the decedent had previously been appointed guardian. Following the decedent’s death, there was protracted litigation regarding the estate, a related trust, and the guardianship, which spanned four years. At the conclusion of the litigation, the attorneys involved submitted fee applications, seeking to be awarded payment.. read more →

A New Jersey appellate court ruled that a court can alter the plain and unambiguous language of a trust when extrinsic evidence suggests that the trust language is not what the settlor intended. In the Matter of the Trust of Violet Nelson, Deceased, Docket No. A-4004-15T1 (App. Div. March 28, 2018). Violet and Joseph Nelson had.. read more →

In this case, the Division of Medical Assistance and Health Services (DMAHS), New Jersey’s state Medicaid agency, affirmed the denial of a Medicaid application filed by Grace M. Vinci (G.V.) by the Monmouth County Division of Social Services (MCDSS) finding that G.V. had resources in excess of $2,000 available to her, namely, resources contained in.. read more →

In 1992, Ann Mark created two irrevocable trusts for the benefit of her three children. In 1997, Jared Scharf became the successor trustee for the trusts, and used some of those assets to form a separate trust for each of Ms. Mark’s three children. Each of the trusts stated that they were governed by New.. read more →

The decedent, Evelyn Berry, had been married twice. At the time of her death, the two children of her first marriage (Darryl and Tara) were adults. The two children of her second marriage (Garrett and Brook) were minors. Evelyn’s will included a testamentary trust for the maintenance, support and education of Garrett and Brook. Darryl.. read more →

Vanarelli & Li, LLC provides Special Needs Trusts and Disability Planning Attorney Services throughout the State of New Jersey. See: https://vanarellilaw.com/special-needs-disability-planning/ Elder Law topics covered in this video include Guardianships, Conservatorships, Power of Attorney, Representative Payeeships (SSA and SSI), Joint Tenancies (including joint bank accounts), Advance Medical Directives (living wills), Do Not Resuscitate (DNR).. read more →

In re Trusts for Stefanidis-Perez is a consolidated case involving two trusts in which the plaintiff is the beneficiary and the defendant (plaintiff’s mother) is the trustee. The plaintiff-beneficiary moved for partial summary judgment seeking to compel an accounting and seeking the removal of the defendant-trustee, and the defendant-trustee cross-moved for summary judgment for advice.. read more →

In this will contest involving the doctrine of probable intent, Hon. Robert P. Contillo, P.J.Ch. ruled that a court cannot alter the language of a trust that is plain and unambiguous even when extrinsic evidence strongly suggests that the trust language is not what the settlor intended. Violet and Joseph Nelson had three children: Jacob.. read more →

An appeals court holds that the Massachusetts Medicaid is not required to recognize the reformation of an applicant’s trust after the original trust was considered an available asset. Needham v. Director of Medicaid (Mass. Ct. App., No. 14-P-182, Oct. 20, 2015). Maurice Needham, a Massachusetts resident, created two trusts. The first, a revocable trust, held the family.. read more →

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media