In 2008, Brian Petronaci (“Brian”) and Laurie Voigt (“Laurie”) were married. They divorced in 2015, and Brian died three years later. As part of their divorce, the couple entered into a marital settlement agreement (“MSA”) without the assistance of legal counsel. That MSA included a “Waiver of Employee… Retirement Benefits,” in which each spouse waived.. read more →

Upcoming Webinar: Planning for Your Child With Special Needs

Upcoming FREE Webinar: REGISTER TODAY Date: Thursday, May 18, 2023 at 4:00 PM EST (Approximately 2 hours, depending on Q & A) Learn to Utilize Special Needs Trusts and ABLE Accounts to Access Medicaid, SSI, DDD Services and Other Public Benefits to Plan for the Future of Your Child With Special Needs Attorneys Donald D… read more →

On November 18, 2021, the New Jersey Supreme Court entered an Order addressing whether proceedings in state courts should be conducted in person or virtually as the COVID-19 pandemic ends. In doing so, the Supreme Court stated that it tried to balance “the reduced time and cost associated with virtual proceedings” with the benefits of.. read more →

A federal court awarded surviving spouse benefits to the surviving partner of a same-sex couple who were prohibited from marrying because of now-unconstitutional state law that banned same-sex marriage. Thornton v. Commissioner of Social Security, Case No. C18-1409JLR, (U.S. District Court, Western District of Washington, September 11, 2020) Helen Josephine Thornton and her partner, Margery.. read more →

Planning the long-term future of a child with special needs can be the source of enormous stress for parents. Among the challenges of raising a child with special needs is figuring out how to provide for that child once you’re gone. If the child will never be able to earn a living, how can you determine.. read more →

On June 5, 2020, the Administrative Office of the Courts issued Directive #18-20, allowing trial courts in New Jersey to enter a judgment granting a divorce in default and uncontested cases on the papers without requiring the parties to appear personally before the court. Judges have discretion to schedule hearings in such matters if necessary.. read more →

Yesterday, April 9th, the New Jersey judiciary launched The Judiciary Electronic Document Submission (JEDS) system, an electronic filing system to ease the filing of cases and slow backlogs while the state remains under an extended health emergency. The JEBS system will allow attorneys and litigants who represent themselves to file their papers electronically in most.. read more →

The New Jersey Supreme Court issued its First Omnibus Order on March 27, 2020 extending by 30 days the deadlines for the suspension of court proceedings and other matters in light of the ongoing public health emergency caused by COVID-19. The previous orders involved criminal, civil, family, tax and municipal courts, and suspended civil and.. read more →

A nurse’s aide at a senior care facility in southern Minnesota posted a photograph of an elderly patient with on social media with a demeaning and vulgar message did not violate state law meant to protect patient privacy, a state court ruled. Furlow v. Madonna Summit of Byron, Docket No. A19-0987 (Minn. Ct. of Appeals,.. read more →

A fiduciary is a fancy legal term for the person who will take care of your property for you if you are unable to do it yourself, such as the executor of an estate, the trustee of a trust, or an attorney-in-fact under a power of attorney. Your first instinct might be to name one.. read more →

The decedent died without a will, and without a spouse, domestic partner, or children. Under the New Jersey laws of intestacy, if a decedent dies without a spouse or domestic partner, the decedent’s “descendants” inherit the estate. A “descendant” is defined to include a “child,” which in turn is defined as “any individual, including a.. read more →

At the time of Carol Rankins’ death in 2015, she had been married to Clyde Rankins for 28 years. She had one adopted daughter and two daughters from a prior relationship. The decedent’s surviving spouse was granted letters of administration of her intestate estate. One of her surviving daughters, Ursula, later filed a complaint seeking.. read more →

Louis Acerra, the decedent, died at the age of 30 from injuries he suffered in a house fire. He survived more than two years after the fire before finally succumbing to those injuries. During those two years, he was cared for by Richard Litwin. Litwin had been in a relationship with the decedent’s mother when.. read more →

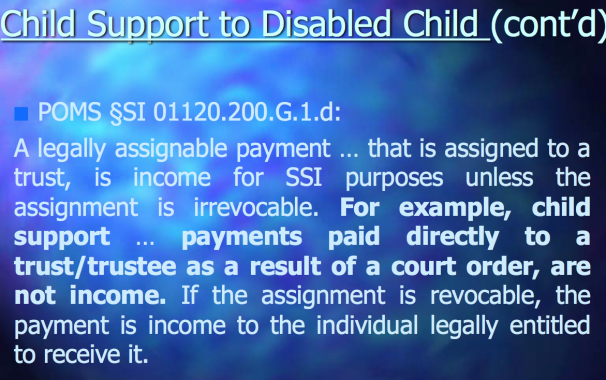

Special Needs Trusts and Divorce / Part 2: Child Support

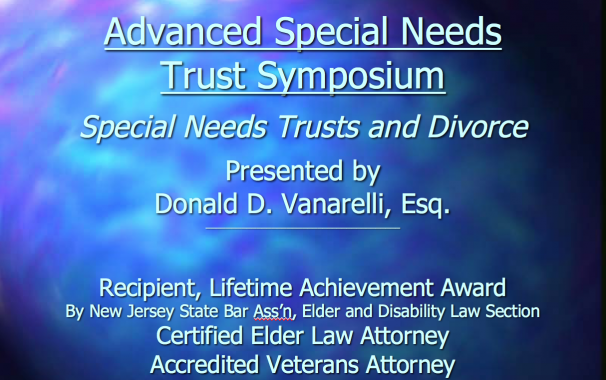

(On December 1, 2016, I moderated the first Advanced Special Needs Trust Symposium, an all-day event held at the New Jersey Law Center. In addition to moderating the panel of speakers, I also presented on the topic of the “Uses of Special Needs Trusts in Cases Involving Divorce.” Due to the length of my paper,.. read more →

Special Needs Trusts and Divorce / Part 1: Alimony and Property Settlement Agreements

(On December 1, 2016, I moderated the first Advanced Special Needs Trust Symposium, an all-day event held at the New Jersey Law Center. In addition to moderating the panel of speakers, I also presented on the topic of the “Uses of Special Needs Trusts in Divorce.” Due to the length of my paper, I divided.. read more →

When he died in 2012, the decedent, retired physician Henry D. Rubenstein, left his insolvent estate to his second wife and her nephew. Although he and his second wife had a son, his will explicitly left no bequest to that son. The second wife claimed that the decedent’s extensive health problems had depleted the estate.. read more →

A few months prior to her death, Basabadatta Pattanayak and her husband Sandeep Srinath executed a Marital Settlement Agreement. The Agreement included a section entitled “Equitable Distribution,” in which they divided their property and relinquished spousal support, and agreed that the husband would pay health insurance until the dissolution of the marriage. When the Agreement.. read more →

Donald D. Vanarelli, Esq. to Moderate the Advanced Special Needs Trust Symposium

“Use of Special Needs Trusts in Cases Involving Divorce” to be presented by leading NJ Elder Law and Estate Planning Attorney, Donald D. Vanarelli, Esq., who will also act as Moderator of the Symposium Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will moderate and present at the Advanced Special Needs Trust Symposium given by the New Jersey Institute.. read more →

The decedent, Keith R. O’Malley, was the father of two children from two different relationships. His minor son, E.L., resided with E.L.’s mother in New York, although O’Malley was a New Jersey resident. O’Malley, who was financially successful, died unexpectedly at the age of 36. In 2008, O’Malley and E.L.’s mother had entered into a.. read more →

In a 3-2 ruling, the New Jersey Supreme Court decided that attorneys can be held liable for counsel fees if they are found to have intentionally breached their fiduciary duty to non-clients. Peter Innes v. Madeline Marzano-Lesnevich, Esq. Peter Innes and his wife, Maria Jose Carrascosa, were married in Spain in 1999, and Victoria, their.. read more →

Pennsylvania Superior Court ruled that a husband’s separation from his wife and subsequent extramarital affairs deprived him of his right to an intestate share of the deceased spouse’s estate. Estate of Kathleen Talerico, __ A.3d __ (No. 728 MDA 2015, filed March 18, 2016). Kathleen and Donald Talerico were married in 2006. The couple resided in.. read more →

Plaintiff, Emmaline O’Hara, and defendant, John B. O’Hara, Jr., were married in 1955. They had two children, Robin, who is deceased, and Kevin, from whom John was estranged. John acquired approximately $6 million in assets during the marriage. In 2012, Emmaline filed for divorce. At that time, Emmaline was 80 years old, and had been.. read more →

Readers of this blog know that applicants for public benefits often appeal the decisions made by the various administrative agencies involved in providing benefits. Applicants appeal for various reasons, usually based on the outright denial of benefits or an award of fewer benefits than anticipated. The appeals are considered and decided by administrative law judges.. read more →

In many divorce cases, when a one spouse or parent is not reporting his or her true income, or is unemployed or underemployed and not earning what he or she could, the court may impute income to that spouse so the proper amount of spousal or child support is paid to the other divorcing spouse… read more →

In a case of first impression, a trial judge in Ocean County ruled that victims of domestic elder abuse can use New Jersey’s Prevention of Domestic Violence Act to obtain restraining orders against their abusers. J.C. v. B.S., Docket No. FV-15-352-16 (Chan. Div., Family Part, Ocean County, September 14, 2015) In an unpublished opinion, Superior.. read more →

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media