Below, in chronological order, is the annual roundup of the top 10 elder law decisions across the nation for the past year, as measured by the number of “unique page views” of the summary of the decision received on the ElderLawAnswers website. ElderLawAnswers is a web-based resource available for those in the public seeking information.. read more →

In Hegadorn v. Department of Human Services, the Michigan Supreme Court approved the use of a trust established for the sole benefit of the healthy spouse as a valid method to protect the assets of a married couple when the ill spouse is a Medicaid recipient in a nursing home or other long-term care facility. The.. read more →

On June 27, 2017, D.A., through his Designated Authorized Representative (DAR), applied to the Burlington County Board of Social Services, the county welfare agency (CWA), for nursing home Medicaid benefits. Prior to submitting the Medicaid application, D.A.’s nursing facility requested pre-admission screening (PAS) on D.A.’s behalf in May 2017 to establish D.A.’s clinical eligibility for.. read more →

On January 29, 2020, I presented at the 2020 ““Elder Law in a Day” seminar given by the New Jersey Institute for Continuing Legal Education at the New Jersey Law Center in New Brunswick, New Jersey. I presented the case law update, summarizing the most significant legal developments over the past year in the areas.. read more →

A Massachusetts court held that the state is not entitled to recover Medicaid benefits from a community spouse’s annuity. Dermody v. The Executive Office of Health and Human Services (Mass. Super. Ct., No. 1781CV02342, Jan. 16, 2020). Robert Hamel purchased an annuity that named the state as primary beneficiary to the extent any Medicaid benefits are.. read more →

The following figures represent the average cost of nursing home care in each region in New York State as determined by the State Department of Health. These figures are used to calculate Medicaid penalty periods for gifts and asset transfers in New York. Long Island (Nassau/Suffolk) $13,407 New York City (5 Boroughs) $12,844 Central (Syracuse,.. read more →

Involuntary Transfers Or Evictions To Another Care Facility “Difficult” residents are often subjected to involuntary eviction on the basis of the resident’s welfare, and that the resident’s needs cannot be met at the current nursing facility. As one commentator notes, “This type of argument is misplaced, however, because it only applies if the resident’s needs.. read more →

R.K. transferred her one-third interest in a house she owned jointly with her daughter and son-in-law to her daughter. Less than five years later, R.K. applied for Medicaid, and asserted that the transfer was exempt under Medicaid’s “caregiver child” exception to the rules prohibiting any transfers of assets within five years of the Medicaid application.. read more →

H.R., who had significant cognitive and functional deficits, was admitted to the Hammonton Center for Rehabilitation and Healthcare (Hammonton Center). The Hammonton Center filed a complaint seeking the appointment of a guardian for H.R. While H.R.’s guardianship was still pending, the Hammonton Center filed a Medicaid application with the Atlantic County Board of Social Services.. read more →

B.F. is an octogenarian who suffered a stroke causing left-side paralysis. B.F. used a wheelchair, and needed assistance with her activities of daily living (ADLs) and instrumental activities of daily living (IADLs). She lived with her long-time friend. When B.F. became eligible for Medicaid, she enrolled in the State’s then-existing Global Options for Long-Term Care.. read more →

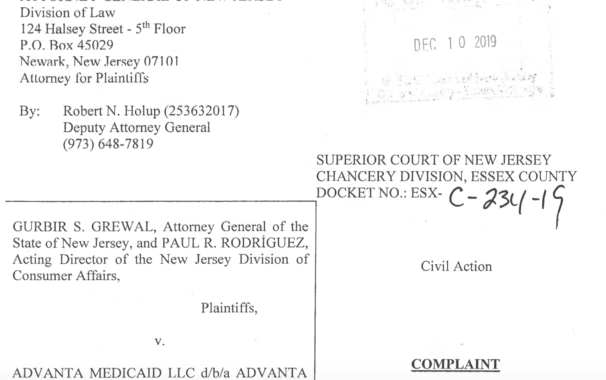

A company that was supposed to help consumers complete Medicaid applications for a fee stole more than $300,000 from clients, according to a lawsuit filed by the New Jersey attorney general and the state Division of Consumer Affairs. The State’s complaint, alleging violations of the Consumer Fraud Act, was filed in New Jersey Superior Court in.. read more →

P.P. had been his mother’s legal guardian, and he was executor of her estate. After her death, Medicaid asserted a statutory lien against her estate in the amount of $132,755, representing the amount of correctly paid medical assistance that had been paid on her behalf. P.P. requested a waiver or compromise of the lien based.. read more →

G.M., a 73 year old stroke victim, was diagnosed with Alzheimer’s disease, vascular dementia, schizoaffective and bipolar disorders. After G.M. filed a Medicaid application, the Atlantic County Board of Social Services (Board) notified G.M. that his application was denied because he did not provide necessary information. Several months later, G.M.’s designated authorized representative (DAR) submitted.. read more →

On November 5, 2019, I presented at the Fall Meeting of the Essex/Hudson/Union Chapter of the New Jersey Association of Public Accountants held at Kean University in Hillside, New Jersey. I presented an overview of the various types of revocable and irrevocable trusts used by estate planners and by elder law and special needs planning.. read more →

Donald D. Vanarelli, Esq. to Discuss Social Security and Medicare Issues at 21st Annual Elder and Disability Law Symposium

21st Annual Elder and Disability Law Symposium Presented in cooperation with the NJSBA Elder and Disability Law Section Format/Skill Level: Meeting Location: APA Hotel Woodbridge, 120 S. Wood Ave Iselin, NJ 08830 Date: December 18, 2019 Time: 9:00 AM – 5:00 PM Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 21st Annual Elder and Disability.. read more →

D.N., a 38 year-old man, was seriously injured in an automobile accident, resulting in quadriplegia. D.N. cannot sit, stand, change positions on his own, or move his arms or legs. He needs to be repositioned when he sleeps to avoid bedsores and maintain skin integrity. As a result, D.N. is eligible to receive Medicaid assistance.. read more →

On September 19, 2019, I presented at the 2019 Fall Conference given by the Aging Life Care Association (Formerly the National Association of Professional Geriatric Care Managers) at the Asbury Hotel in Asbury Park, New Jersey. My presentation was an overview of the various types of irrevocable trusts used by elder law and special needs planning.. read more →

T.M., a 23 year old disabled woman, has spinal muscular atrophy, is paralyzed, and is dependent on a ventilator to breathe. She resides with her grandmother who is also her primary caregiver. For many years, T.M. had been receiving private duty nursing (PDN) and personal care assistance (PCA) services through Medicaid under the Early and.. read more →

H.T. was admitted to a nursing home in Union City, NJ. Soon thereafter, a Medicaid application for the Nursing Home Medicaid program was filed on H.T.’s behalf. Under the Medicaid regulations, applicants for the Nursing Home Medicaid Program must be found clinically eligible to qualify for benefits. After an evaluation by the Medicaid agency to.. read more →

L.A., a nursing home resident, applied for Medicaid benefits to pay for long-term care costs. G.A., L.A.’s husband, and L.A. employed a firm to assist them with the Medicaid application process. Although years before filing the Medicaid application G.A. and L.A. transferred their home into a revocable trust, the firm failed to provide copies of.. read more →

The 2019 “Elder Law in a Day” Seminar: Learn How To Handle Elder Law Issues And Cases Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 2019 “Elder Law in a Day” seminar given by the New Jersey Institute for Continuing Legal Education on January 29, 2020 at the New Jersey Law Center, 1 Constitution.. read more →

Medicaid is a critical lifeline for many low-income, elderly, or disabled New Jersey residents who, without Medicaid, would have no access to health insurance or to a critical source of funds to pay for long-term care costs or nursing home admission. However, the Medicaid eligibility process is incredibly confusing and tedious. Under the current Medicaid.. read more →

Moses Ratowsky created an irrevocable trust for the benefit of his grandson, Daniel Schreiber (hereinafter the grandson). Petitioners, the co-trustees of the irrevocable trust, filed an application to appoint the principal of the trust to a new special needs trust that would allow the grandson to retain the benefits of the original trust while preserving.. read more →

E.S. was admitted to Brookdale Assisted Living Facility (Brookdale) in April 2015. E.S. was paying for care privately from her own savings at that time. Realizing in December 2016 that E.S.’s financial resources would cover the cost of care for only a few more months, B.S., E.S.’s daughter and authorized representative, asked Brookdale to start.. read more →

In August 1998, M.A., and her daughter, also named M.A., opened a bank account at Hudson United Bank, which is now TD Bank. M.A.’s daughter contributed all of the funds to the bank account. While both petitioner and her daughter each had a legal right to independently withdraw funds from the bank account, petitioner never.. read more →

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media