On September 19, 2019, I presented at the 2019 Fall Conference given by the Aging Life Care Association (Formerly the National Association of Professional Geriatric Care Managers) at the Asbury Hotel in Asbury Park, New Jersey. My presentation was an overview of the various types of irrevocable trusts used by elder law and special needs planning.. read more →

Moses Ratowsky created an irrevocable trust for the benefit of his grandson, Daniel Schreiber (hereinafter the grandson). Petitioners, the co-trustees of the irrevocable trust, filed an application to appoint the principal of the trust to a new special needs trust that would allow the grandson to retain the benefits of the original trust while preserving.. read more →

The Social Security Administration (SSA) is proposing regulations which may make it more difficult for people who don’t speak English to qualify for disability benefits. Under planned regulations released February 01, 2019, the SSA would no longer consider a person’s “inability to communicate in English” when reviewing applications, both for Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) benefits. The.. read more →

This blog post discusses recent changes in how the Social Security Administration (SSA) evaluates disbursements from trusts, particularly special needs trusts. SSA regulations are published by the agency and compiled in the Program Operations Manual System (POMS). The POMS is a primary source of information used by Social Security employees to process claims for Social.. read more →

Social Security Disability Insurance (SSDI) is one of the major federal programs that provides monetary assistance to people with disabilities. Supplemental Security Income (SSI) is a federal program that helps people with disabilities and very low income and assets pay for food and shelter. SSDI is often confused with SSI. Although both programs pay benefits to.. read more →

Every year we release the key dollar amounts that are frequently used in elder law, estate administration and special needs trust planning, including Medicaid figures, Medicare premiums, Social Security Disability, and Supplemental Security Income. Be sure to check back often, as we will add any information that has not yet been released and update the page.. read more →

With the aging population becoming increasingly tech savvy, the Social Security Administration (SSA) has moved a lot of services online. From applying for Social Security benefits to replacing a card, the SSA has online tools to help. To access most of the online services, you need to create a my Social Security account. This account allows you to.. read more →

The Social Security Administration (SSA) has announced the 2019 cost-of-living increases for Social Security and Supplemental Security Income (SSI) benefits. SSA announced a 2.8% benefit increase in 2019, and an increase in the SSA taxable maximum amount to $132,900. The federal benefit amount for an individual eligible for SSI in 2019 will increase to $771 per month. The information.. read more →

After a trial court, expressing its disagreement with the legislative policy underlying special needs trusts, placed only a portion of the net settlement proceeds of a lawsuit brought on behalf of a severely disabled person into a special needs trust and ordered the remaining funds be paid directly to the disabled person, resulting in the.. read more →

The Achieving a Better Life Experience (ABLE) Act allows people with disabilities who became disabled before they turned 26 to set aside up to $15,000 per year in tax-free savings accounts without affecting his or her eligibility for government benefits like Medicaid and Supplemental Security Income (SSI). This money can come from the disabled individual.. read more →

Recently, the Social Security Administration (SSA) published Transmittal No. 74, revising Part 05 of SSA’s Program Operations Manual System (POMS) covering Resource Exclusions in the Supplemental Security Income (SSI) Program pertaining to Achieving a Better Life Experience (ABLE) Accounts. In the introduction to the new ABLE POMS, SSA said: Background This transmittal includes the current published guidance.. read more →

Our law firm has created a number of Legal Guides for our clients and website guests to provide a better understanding of important and oftentimes complex legal subjects. The Legal Guides are offered free of charge. One of the Legal Guides available to the public discusses Special Needs Trusts and Special Needs Planning. Parents of children.. read more →

Upcoming Presentation on Special Needs Planning and Special Needs Trusts for Community Access Unlimited

Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will provide an overview of the use of Special Needs Trusts (SNTs) by disabled persons so as to prevent an applicant’s financial assets and income from impacting eligibility for needs-based public benefits such as Supplemental Security Income (SSI), Medicaid, services from the Division of Developmental Disabilities (DDD), Section 8 Housing and.. read more →

I came across the 2018 version of a Social Security Administration (SSA) publication below. Not only has the agency updated the publication to include Special Needs Trusts, but SSA added information about Achieving a Better Life Experience (ABLE) accounts as well. And the agency included hyperlinks to other helpful information. This may assist applicants with.. read more →

The Centers for Medicare and Medicaid Services (CMS) has released its Spousal Impoverishment Standards for 2018. The official spousal impoverishment allowances for 2018 are as follows: Community Spouse Resource Allowance The “community spouse resource allowance” is a protection provided under Medicaid law for the healthy spouse of an applicant for benefits (called the “community spouse”) to.. read more →

New Jersey’s ABLE law (the acronym is short for “Achieving a Better Life Experience”) went into effect a few months ago, in October 2016. Under the new law, New Jersey’s Department of Human Services and the Department of the Treasury are required to establish the ABLE Program pursuant to federal law. Persons who became disabled.. read more →

The Social Security Administration (SSA) published two final regulations that will have significant impacts on the disability determination process for those applying for Social Security Disability Insurance benefits and those applying for Supplemental Security Income (SSI) benefits on the basis of disability. The first set of regulations, Revisions to Rules Regarding the Evaluation of Medical.. read more →

In Simonsen v Bremby(2d Cir., No. 16-204-cv, Feb. 15, 2017), the daughter/Medicaid applicant filed suit in federal court and sought a preliminary injunction barring Medicaid from imposing a penalty period as a result of trusts established for her benefit by her mother. The two third-party trusts were considered as available resources by Medicaid, and when.. read more →

The Division of Developmental Disabilities (DDD) is a division of New Jersey’s Department of Human Services. The DDD provides public funding for certain services designed to assist eligible New Jersey adults with intellectual and developmental disabilities, age 21 and older, to live as independently as possible. The DDD has developed a new resource for families.. read more →

To ensure that all beneficiaries can receive their payments and make proper use of funds, Congress has granted the Social Security Administration (SSA) the authority to appoint third parties, known as representative payees, to receive and manage payments when the beneficiary is unable to do so. A representative payee is an individual or organization appointed.. read more →

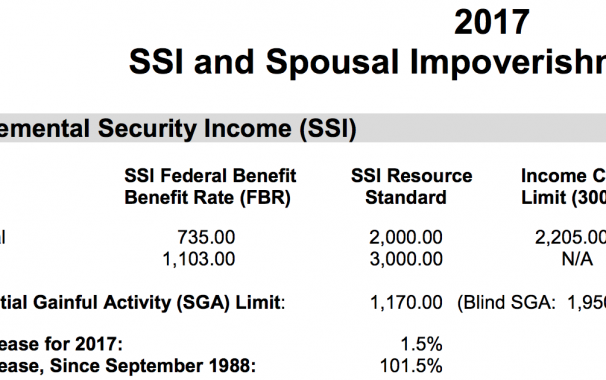

The Centers for Medicare and Medicaid Services has released its SSI and Spousal Impoverishment Standards for 2017. SUPPLEMENTAL SECURITY INCOME (SSI) SSI Federal Benefit Rate for an Individual: $735.00 SSI Federal Benefit Rate for a Couple: $1,103.00 Substantial Gainful Activity (SGA) Limit: $1,170.00 (Blind SGA: $1,950.00) MEDICAID Minimum Community Spouse Resource Allowance: $24,180 Maximum Community Spouse.. read more →

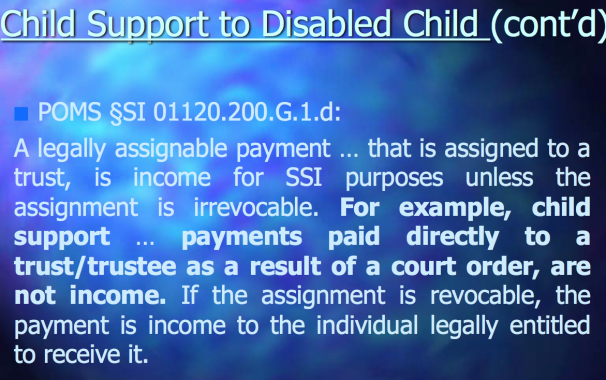

Special Needs Trusts and Divorce / Part 2: Child Support

(On December 1, 2016, I moderated the first Advanced Special Needs Trust Symposium, an all-day event held at the New Jersey Law Center. In addition to moderating the panel of speakers, I also presented on the topic of the “Uses of Special Needs Trusts in Cases Involving Divorce.” Due to the length of my paper,.. read more →

Special Needs Trusts and Divorce / Part 1: Alimony and Property Settlement Agreements

(On December 1, 2016, I moderated the first Advanced Special Needs Trust Symposium, an all-day event held at the New Jersey Law Center. In addition to moderating the panel of speakers, I also presented on the topic of the “Uses of Special Needs Trusts in Divorce.” Due to the length of my paper, I divided.. read more →

Question: Does a Section 529 educational savings plan account impact the eligibility of a minor receiving Supplemental Security Income (SSI) benefits? Are there any regulations governing such plans? Answer: Qualified Tuition Programs (QTPs), also referred to as Section 529 educational savings plans, allow individuals to contribute to an account established to pay a designated beneficiary’s.. read more →

Donald D. Vanarelli, Esq. to Moderate the Advanced Special Needs Trust Symposium

“Use of Special Needs Trusts in Cases Involving Divorce” to be presented by leading NJ Elder Law and Estate Planning Attorney, Donald D. Vanarelli, Esq., who will also act as Moderator of the Symposium Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will moderate and present at the Advanced Special Needs Trust Symposium given by the New Jersey Institute.. read more →

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media