Chen Li, Esq. (http://VanarelliLaw.com/) will present on Trusts and Trust Taxation Issues impacting the New Jersey Probate and Trust Administration Process in an online seminar given by the National Business Institute (NBI) on December 15, 2022. Ms. Li will discuss aspects of the probate process and trust administration in New Jersey. Specifically, Ms. Li will.. read more →

2022 Elder Law Fact Sheet

Every year we release the key dollar amounts that are frequently used in elder law, estate administration and special needs trust planning, including Medicaid figures, Medicare premiums, Social Security Disability and Supplemental Security Income. Be sure to check back often, as we will add any information that has not yet been released and update the.. read more →

The Internal Revenue Service (IRS) has announced that the tax deduction for medical expenses includes amounts spent on face masks, hand sanitizer, sanitizing wipes and related equipment, as long as the primary purpose for the purchase was to prevent the spread of COVID-19. Specially, the IRS announcement states that: [A]mounts paid for personal protective equipment,.. read more →

Under Section 728 of Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (TURCA), federal tax refunds received after December 31, 2009 are not treated as income or resources (for a period of 12 months after receipt) for purposes of determining eligibility for all federal or federally-assisted programs, including Medicaid and the Children’s.. read more →

Every year we release the key dollar amounts that are frequently used in elder law, estate administration and special needs trust planning, including Medicaid figures, Medicare premiums, Social Security Disability and Supplemental Security Income. Be sure to check back often, as we will add any information that has not yet been released and update the.. read more →

Tax Benefit Checklist for Families Caring for Special Needs Children Unique tax benefits are available to families with individuals who have special needs. A checklist compiled by Thomas M. Brinker, Jr., a professor of accounting at Arcadia University in Pennsylvania, of some potential tax benefits that could be available to families who care for a special.. read more →

The estate tax is a tax on your right to transfer property at your death. The estate tax is computed based on the value of everything you own or have an interest in at the time of your death. In contrast, the federal gift tax is payable if you give someone money or property during.. read more →

Donald D. Vanarelli, Esq. Will Present At The 22nd Annual Elder And Disability Law Symposium

22nd Annual Elder And Disability Law Symposium The COVID Cloud: Pandemic Practice Tips for the Elder Law and Special Needs Practitioner Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 22nd Annual Elder and Disability Law Symposium to be held via ZOOM Webinar on December 1, 2020 by the New Jersey State Bar Association Elder.. read more →

Find out how you can save money with disability-related expenses by having an ABLE account. For more information, go to https://www.irs.gov/taxreform. #disability #ABLE #IRS Resources on the IRS website concerning ABLE accounts: Tax law changes enable eligible people with Achieving a Better Life Experience (ABLE) accounts to put more money into their ABLE account and.. read more →

Seniors and retirees may be able to use online tax preparation software free of charge. Most low- and middle-income Americans qualify for the free help, but do not take advantage of it. And all seniors are eligible for free counseling assistance from the IRS. The IRS Free File website links to the available free online tax.. read more →

The 2020 “Elder Law in a Day” Seminar: Learn How To Handle Elder Law Issues And Cases Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 2020 “Elder Law in a Day” seminar given by the New Jersey Institute for Continuing Legal Education on January 29, 2020 at the New Jersey Law Center, 1 Constitution.. read more →

Every year we release the key dollar amounts that are frequently used in elder law, estate administration and special needs trust planning, including Medicaid figures, Medicare premiums, Social Security Disability and Supplemental Security Income. Be sure to check back often, as we will add any information that has not yet been released and update the.. read more →

Donald D. Vanarelli, Esq. to Discuss Social Security and Medicare Issues at 21st Annual Elder and Disability Law Symposium

21st Annual Elder and Disability Law Symposium Presented in cooperation with the NJSBA Elder and Disability Law Section Format/Skill Level: Meeting Location: APA Hotel Woodbridge, 120 S. Wood Ave Iselin, NJ 08830 Date: December 18, 2019 Time: 9:00 AM – 5:00 PM Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 21st Annual Elder and Disability.. read more →

The 2019 “Elder Law in a Day” Seminar: Learn How To Handle Elder Law Issues And Cases Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 2019 “Elder Law in a Day” seminar given by the New Jersey Institute for Continuing Legal Education on January 29, 2020 at the New Jersey Law Center, 1 Constitution.. read more →

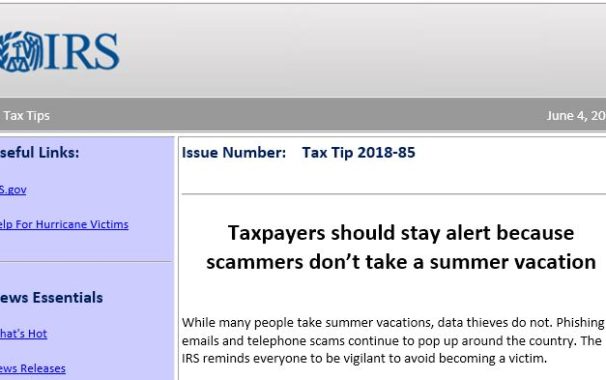

Many taxpayers recently filed their taxes and may be waiting for a response from the IRS. Because of this summertime tends to be a period when thieves increase their scam attempts. They try to get people to disclose personal information like Social Security numbers, account information and passwords. To avoid becoming a victim, taxpayers should.. read more →

While many people take summer vacations, data thieves do not. Phishing emails and telephone scams continue to pop up around the country. The IRS reminds everyone to be vigilant to avoid becoming a victim. Here are some things for taxpayers to remember so they can keep their personal data safe: The IRS does not leave.. read more →

The House Republicans tax proposal introduced today ends the Medical Expense Deduction. This change will cause major harm to individuals and families trying to pay for the catastrophic costs of long-term services and supports (LTSS). About half (52%) of Americans turning 65 today will develop a condition that requires LTSS. Individuals needing LTSS are those.. read more →

New Jersey lawmakers reached an agreement on Friday, September 30th which, among other things, will phase out New Jersey’s state estate tax. The New Jersey estate tax exemption, presently $675,000, will increase to $2 million after January 1, 2017. The estate tax will then be eliminated after January 1, 2018. An official vote on an estate.. read more →

When you sell a capital asset, the sale normally results in a capital gain or loss. A capital asset includes most property you own for personal use or own as an investment. Here are 10 facts that you should know about capital gains and losses: Capital Assets. Capital assets include property such as your home.. read more →

71st Semi-Annual Tax and Estate Planning Forum Our country is experiencing a growing number of households in which a parent and an adult child reside together. Census data reveals that the number of Americans living in multi-generational family households is the highest it has been since the 1950s, with a significant increase in recent years… read more →

A Chancery Court judge determined that the administrator of an insolvent estate in New Jersey must first exhaust all efforts to satisfy creditors from probate assets before the attachment of non-probate assets should be considered. Matter of the Estate of Turco, Chancery Div., Probate Part-Essex County (Koprowski, J.S.C., July 22, 2013) Jerry Turco died testate.. read more →

New York recognized the marriage of state residents Edith Windsor and Thea Spyer, who wed in Ontario, Canada, in 2007. When Spyer died in 2009, she left her entire estate to Windsor. Windsor sought to claim the federal estate tax exemption for surviving spouses, but was barred from doing so by a federal law called.. read more →

The Internal Revenue Service (IRS) recently issued Revenue Procedure 2012-41 which set forth inflation-adjusted revenue items for 2013. Among other things, the IRS announced that the annual gift tax exclusion amount will increase in 2013 to $14,000 made by a taxpayer to any person who is not the taxpayer’s spouse. Married couples can combine their annual exclusion amounts.. read more →

Under existing federal law, spouses who pass away can leave property of any value to their surviving spouses free of federal estate taxes. This is called the “unlimited marital deduction.” However, under the Defense of Marriage Act (DOMA), a federal law passed in 1996, marriage is defined as “only a legal union between one man.. read more →

Currently, the value of assets passing to heirs upon the death of a U.S. citizen free of federal estate taxes, called the federal estate tax exemption amount, is $5.12 million dollars per person. This federal estate tax exemption amount is valid through the end of 2012. In the past, upon the death of the first.. read more →

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media