R.K. transferred her one-third interest in a house she owned jointly with her daughter and son-in-law to her daughter. Less than five years later, R.K. applied for Medicaid, and asserted that the transfer was exempt under Medicaid’s “caregiver child” exception to the rules prohibiting any transfers of assets within five years of the Medicaid application.. read more →

Revocable trusts are an effective way to avoid probate and provide for asset management in the event of incapacity. In addition, revocable trusts–sometimes called “living” trusts–are incredibly flexible and can achieve many other goals, including tax, long-term care, and asset-protection planning. A trust is a legal arrangement through which one person holds legal title to property.. read more →

The 2020 “Elder Law in a Day” Seminar: Learn How To Handle Elder Law Issues And Cases Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 2020 “Elder Law in a Day” seminar given by the New Jersey Institute for Continuing Legal Education on January 29, 2020 at the New Jersey Law Center, 1 Constitution.. read more →

H.R., who had significant cognitive and functional deficits, was admitted to the Hammonton Center for Rehabilitation and Healthcare (Hammonton Center). The Hammonton Center filed a complaint seeking the appointment of a guardian for H.R. While H.R.’s guardianship was still pending, the Hammonton Center filed a Medicaid application with the Atlantic County Board of Social Services.. read more →

Every year we release the key dollar amounts that are frequently used in elder law, estate administration and special needs trust planning, including Medicaid figures, Medicare premiums, Social Security Disability and Supplemental Security Income. Be sure to check back often, as we will add any information that has not yet been released and update the.. read more →

To our Clients: We want to sincerely thank you for trusting us as your legal counsel this year. It has been a pleasure helping you reach your goals, and we look forward to contributing to your success in 2020. We wish you a prosperous and very happy new year! ******* To our Colleagues: Thank you.. read more →

B.F. is an octogenarian who suffered a stroke causing left-side paralysis. B.F. used a wheelchair, and needed assistance with her activities of daily living (ADLs) and instrumental activities of daily living (IADLs). She lived with her long-time friend. When B.F. became eligible for Medicaid, she enrolled in the State’s then-existing Global Options for Long-Term Care.. read more →

The Nursing Home Reform Act of 1987 (“NHRA”) was enacted by Congress to provide “sweeping reform” in response to widespread issues of abuse, neglect, inadequate care, and general denial of residents’ basic rights in nursing facilities. Revised regulations for nursing facilities were released by the Centers for Medicare & Medicaid Services (“CMS”) in 2016. These.. read more →

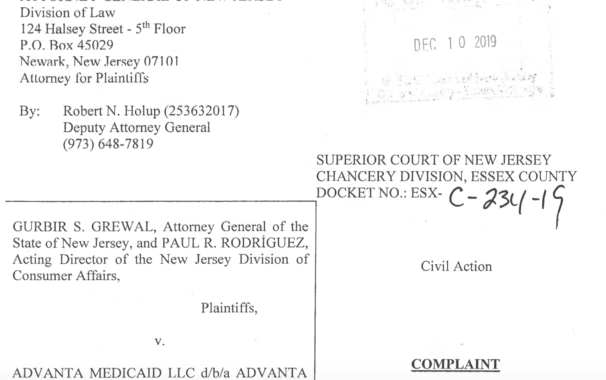

A company that was supposed to help consumers complete Medicaid applications for a fee stole more than $300,000 from clients, according to a lawsuit filed by the New Jersey attorney general and the state Division of Consumer Affairs. The State’s complaint, alleging violations of the Consumer Fraud Act, was filed in New Jersey Superior Court in.. read more →

P.P. had been his mother’s legal guardian, and he was executor of her estate. After her death, Medicaid asserted a statutory lien against her estate in the amount of $132,755, representing the amount of correctly paid medical assistance that had been paid on her behalf. P.P. requested a waiver or compromise of the lien based.. read more →

Vanarelli & Li, LLC is committed to providing our clients with the highest level of legal service, professionalism, personalized attention, and expertise. When a client takes the time to share their positive experience with others, it speaks volumes. By sharing these testimonials, it gives others peace of mind knowing that they are choosing the right law.. read more →

In 2003, Dr. Robert Binder retained attorney Richard Ledingham to draft a second codicil to a Last Will and Testament and First Codicil. Shortly after Dr. Binder died on August 1, 2011, Mary Kay Binder, decedent’s spouse – who was 88 years old at the time – retained attorney Ledingham to represent her as Executrix.. read more →

Happy December to clients, friends and readers. Listed below are the ten (10) eleven (11) blog posts on the Vanarelli Law Office blog with the highest readership in 2019. After each hyperlinked blog post title, the original post date and summary of the post are included. Check the list of blog posts to see this.. read more →

G.M., a 73 year old stroke victim, was diagnosed with Alzheimer’s disease, vascular dementia, schizoaffective and bipolar disorders. After G.M. filed a Medicaid application, the Atlantic County Board of Social Services (Board) notified G.M. that his application was denied because he did not provide necessary information. Several months later, G.M.’s designated authorized representative (DAR) submitted.. read more →

On November 20, 2019, I presented at the 2019 “The Medical Side of Elder Law” seminar given by the New Jersey Institute for Continuing Legal Education at the Hilton/Doubletree Hotel in Fairfield, New Jersey. I presented an overview of the rights of residents of nursing homes and other care facilities under federal and state laws.. read more →

The issue in this appeal is whether a widow can modify the retirement application of her recently deceased husband, who was a member of the Teachers’ Pension and Annuity Fund (Pension Fund), even though his application was never approved because he selected a retirement option for which he was ultimately ineligible. David and Christine Minsavage.. read more →

The Internal Revenue Service (IRS) has announced the amount taxpayers can deduct from their 2020 income as a result of buying long-term care insurance. Premiums for “qualified” long-term care insurance policies are tax deductible for the taxpayer, his or her spouse and other dependents to the extent that the premiums, along with other unreimbursed medical expenses.. read more →

In 1995, Frances and Larnie Shaw, prepared a number of estate planning documents. One of the documents, a testamentary trust created by Frances, was known as “Credit Shelter Trust.” Larnie and Janice, one of the Shaws’ three daughters, were designated as co-trustees of the Credit Shelter Trust. The Shaws’ other daughters were Carolyn and Shirley… read more →

On November 5, 2019, I presented at the Fall Meeting of the Essex/Hudson/Union Chapter of the New Jersey Association of Public Accountants held at Kean University in Hillside, New Jersey. I presented an overview of the various types of revocable and irrevocable trusts used by estate planners and by elder law and special needs planning.. read more →

The decedent, Felix Fornaro, had two children: his daughter Linda (plaintiff) and his son Carmine (defendant). In December 2011, the decedent executed a Last Will and Testament leaving 80% of his estate Carmine and 10% to Linda, with the remainder passing to his grandchildren. A year later, Mr. Fornaro died. Linda challenged the 2011 will… read more →

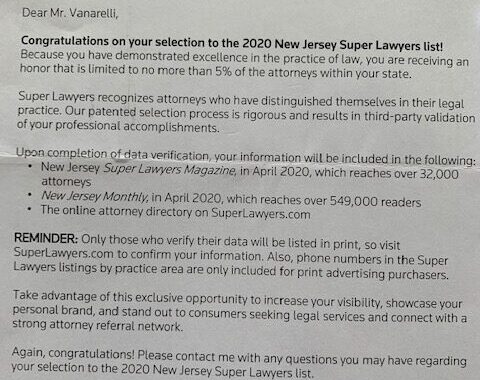

We are pleased to announce that Donald D. Vanarelli has been recognized as a 2020 New Jersey Super Lawyer in Elder Law. This is the 14th consecutive year in which Mr. Vanarelli has been named to New Jersey’s Super Lawyers list. Super Lawyers is a rating service of outstanding lawyers from more than 70 practice areas who have.. read more →

Donald D. Vanarelli, Esq. to Discuss Social Security and Medicare Issues at 21st Annual Elder and Disability Law Symposium

21st Annual Elder and Disability Law Symposium Presented in cooperation with the NJSBA Elder and Disability Law Section Format/Skill Level: Meeting Location: APA Hotel Woodbridge, 120 S. Wood Ave Iselin, NJ 08830 Date: December 18, 2019 Time: 9:00 AM – 5:00 PM Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 21st Annual Elder and Disability.. read more →

Supplemental Security Income (SSI) is a federal program that helps people with disabilities and very low income and assets. Approximately 8.1 million Americans rely on a monthly SSI benefit to pay for their basic needs including rent, food, transportation, utilities, and healthcare co-pays. In order to qualify for SSI, you must be aged, blind or.. read more →

2019 Elder Law College Format/Skill Level: Meeting Location: Doubletree By Hilton, 690 Route 46 E Fairfield, NJ 07004 Date: December 10, 2019 Time: 9:00 AM – 4:00 PM ET Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 2019 Elder Law College given by the New Jersey Institute for Continuing Legal Education on December 10,.. read more →

D.N., a 38 year-old man, was seriously injured in an automobile accident, resulting in quadriplegia. D.N. cannot sit, stand, change positions on his own, or move his arms or legs. He needs to be repositioned when he sleeps to avoid bedsores and maintain skin integrity. As a result, D.N. is eligible to receive Medicaid assistance.. read more →

On October 11, 2016, the decedent’s 2014 will was admitted to probate by her niece Frances (the “defendant-executor”). Therefore, pursuant to R. 4:85-1 of the New Jersey Rules of Court, a complaint seeking to contest the will should have been filed within 4 months of probate, or in this case, by February 10, 2017. However,.. read more →

A new report finds that almost no retirees are making financially optimal decisions about when to take Social Security and are losing out on more than $100,000 per household in the process. Social Security benefits are fundamental to the financial security of most retirees. About 50% of current retirees report that more than half of.. read more →

The Medical Side of Elder Law 2019 Location: New Jersey Law Center, 1 Constitution Sq. New Brunswick, NJ 08901 Date: November 20, 2018 Time: 9:00 AM – 4:00 PM ET Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 2019 “The Medical Side of Elder Law” seminar given by the New Jersey Institute for Continuing Legal Education.. read more →

On September 19, 2019, I presented at the 2019 Fall Conference given by the Aging Life Care Association (Formerly the National Association of Professional Geriatric Care Managers) at the Asbury Hotel in Asbury Park, New Jersey. My presentation was an overview of the various types of irrevocable trusts used by elder law and special needs planning.. read more →

The needs-based pension program from the Department of Veterans Affairs (VA) is a disability benefits program available to compensate veterans for non-service-connected disabilities. Like the VA compensation program, the pension program is based upon disability. However, unlike the VA compensation program, the pension program is also based on income and need, and the veteran’s disability.. read more →

Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 2019 ALCA – New Jersey Fall Conference given by the Aging Life Care Association (Formerly the National Association of Professional Geriatric Care Managers) on September 19, 2019 at the Asbury Hotel, 210 5th Ave, Asbury Park, New Jersey. This is a full day program, from 8:00.. read more →

T.M., a 23 year old disabled woman, has spinal muscular atrophy, is paralyzed, and is dependent on a ventilator to breathe. She resides with her grandmother who is also her primary caregiver. For many years, T.M. had been receiving private duty nursing (PDN) and personal care assistance (PCA) services through Medicaid under the Early and.. read more →

H.T. was admitted to a nursing home in Union City, NJ. Soon thereafter, a Medicaid application for the Nursing Home Medicaid program was filed on H.T.’s behalf. Under the Medicaid regulations, applicants for the Nursing Home Medicaid Program must be found clinically eligible to qualify for benefits. After an evaluation by the Medicaid agency to.. read more →

L.A., a nursing home resident, applied for Medicaid benefits to pay for long-term care costs. G.A., L.A.’s husband, and L.A. employed a firm to assist them with the Medicaid application process. Although years before filing the Medicaid application G.A. and L.A. transferred their home into a revocable trust, the firm failed to provide copies of.. read more →

The Law Office of Vanarelli & Li, LLC is committed to providing clients with the highest level of professionalism, compassionate service, personal attention and legal expertise. We provide a broad range of legal services for seniors, the disabled and their families. We guide our clients through the complex areas of elder law, estates and trusts,.. read more →

Search

Call Us Today

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media