The Superior Court of New Jersey, Appellate Division, affirmed a decision of the Director of New Jersey Medicaid reversing a ruling of an Administrative Law Judge (ALJ) who reduced C.W.’s Medicaid ineligibility penalty previously assessed for transferring assets for less than fair market value. C.W. v. Division of Medical Assistance and Health Services, Docket No. A-2352-13T2.. read more →

Federal court rules that federal law does not require a State to disregard a transfer of a life estates by a Medicaid applicant to a disabled veteran. Pike ex rel. Estate of Pike v. Sebelius (D. R.I., No. CA 13-392 S, July 16, 2015). The late mother of plaintiff F. Norris Pike transferred of two life.. read more →

E.A. began residing in a home owned by her adult daughter, B.C., in September 2004. From September 2004 to June 2005, B.C. received no compensation for any caregiver services or lodging provided to her mother. From June 2005 to September 2006, B.C. received E.A.’s Social Security benefits of approximately $1500 per month to offset the.. read more →

In the C.C. v. Division of Medical Assistance and Health Services case, plaintiff filed an application for nursing home Medicaid benefits which was denied by the Ocean County Board of Social Services. The agency imposed a penalty, or a period of ineligibility, on her application. That is, the agency found that plaintiff sold her residence during.. read more →

Top 10 New Jersey Elder Law and Special Needs Planning Cases Decided in 2014

The 17th Annual Elder Law Retreat, presented by the New Jersey State Bar Association Elder and Disability Law Section, was held on April 21 – 23, 2015 in Philadelphia, PA. At least two significant events occurred at the Retreat this year. First, I was presented with a Lifetime Achievement Award, recognizing my “advocacy in elder and.. read more →

Here are checks from the State of New Jersey issued to plaintiffs’ counsel as a result of the award of attorneys fees granted by the federal court in the Galletta v. Velez class action lawsuit:: As I reported in an earlier blog post, earlier this month a Consent Order was filed in federal district court in New.. read more →

In February 2015, a Consent Order was filed in New Jersey federal district court, concluding a hard-fought class action lawsuit. In the Order, the State of New Jersey agreed to amend its Medicaid program on a State-Wide basis to exclude pension benefits paid by the Department of Veterans Affairs (VA) when determining an applicant’s eligibility for.. read more →

Two years ago, in 2013, a federal judge in New Jersey granted a preliminary injunction to Elizabeth Flamini, a Medicaid applicant who successfully sued for an injunction preventing the State of New Jersey from counting an annuity owned by Mrs. Flamini’s husband Angelo as an available resource in determining Medicaid eligibility. Flamini v. Velez ,.. read more →

Florida’s Supreme Court ruled that non-lawyers who engage in various Medicaid planning activities are engaging in the unlicensed practice of law. The Florida Bar Re: Advisory Opinion — Medicaid Planning Activities by Nonlawyers (Fla., No. SC14-211, Jan. 15, 2015). The Elder Law Section of the Florida State Bar asked the Florida Bar Association to consider whether.. read more →

An Administrative Law Judge found a Medicaid applicant eligible for benefits even though the applicant was impoverished because her spouse gambled away a substantial inheritance. M.Y v. Union County Board of Social Services M.Y., a 96 year old woman, suffered from dementia, could not care for her own needs, and was destitute. She was admitted.. read more →

By notice contained in Medicaid Communication 14 – 15 issued on December 19, 2014, the State of New Jersey formally announced the official end of the Medicaid Medically-Needy program. Medically-Needy Medicaid no longer accepted applications after November 30, 2014. Beginning on December 1, 2014, individuals seeking Medicaid to pay nursing home costs as well as home.. read more →

Supplemental Security Income (SSI): Effective 1-1-15 SSI Federal Benefit Rate SSI Resource Maximum For an Individual – $733.00 2,000.00 For a Couple – $1,100.00 3,000.00 New Jersey State Supplement: New Jersey supplements the federal benefit rate with additional money. The payment received by SSI recipients each month includes.. read more →

New Jersey Medicaid may not count IRAs, 401(k) and pension plans owned by the spouse of an applicant in determining eligibility if funds may be withdrawn only by borrowing against the retirement assets. Avery v. Union County Division of Social Services Rose Avery admitted her husband, Friend Avery, to a nursing home in July 1997. After.. read more →

As discussed in a prior blog post, a major overhaul of Medicaid will be introduced in New Jersey in the coming months. The new Medicaid program is called Managed Long Term Services and Supports (MLTSS). The MLTSS implementation date has been repeatedly adjourned, and the next date scheduled to put the new program into effect.. read more →

New Jersey’s Qualified Income Trust Template For many years, Medicaid programs available to elderly and disabled New Jersey residents to help pay for long-term care costs have been quite limited. The Medicaid-Only Medicaid program pays the care costs of nursing home residents. A companion program, Global Options for Long-Term Care, pays care costs for residents.. read more →

In In re Tomei Trust, in connection with a family dispute regarding ownership of a business, plaintiff sought to terminate a trust he established, in which his father was the trustee. Plaintiff claimed that his father misappropriated trust funds, and asserted that the trust termination date was August 18, 2003. Plaintiff claimed that, despite the.. read more →

Gifts made during the Medicaid look-back period result in a penalty, or period of ineligibility, unless the applicant can prove that the gifts were made exclusively for some purpose other than to qualify for Medicaid. S.L. v. Division of Medical Assistance and Health Services, Docket No. A-3520-11T4 (App. Div., September 2, 2014) In December 2009,.. read more →

The Medicaid programs in New Jersey which help residents pay long-term care costs are about to get a major overhaul. Currently, there are three (3) Medicaid programs in New Jersey that pay for long-term care costs. The Medicaid-Only Medicaid program pays the costs of caring for nursing home residents. A companion program, Global Options for.. read more →

(In Zahner v. Mackereth (U.S. Dist. Ct., W.D. PA, Jan. 16, 2014), a federal district court ruled that long-term annuities, that is, annuities with payment terms of 5-years or more, purchased by Medicaid applicants were not transfers for less than fair market value and, therefore, were not subject to a penalty period, but that shorter-term annuities.. read more →

In a very unusual ruling, a New York appeals court ruled that, despite transferring significant assets to family members, an applicant still qualified for Medicaid because the transfers were made exclusively for a purpose other than to qualify for benefits. Matter of Safran v. Shah, Docket No. D42144 (App. Div., 2nd Dept., July 2, 2014).. read more →

In Brill v. Velez (U.S. Dist. Ct., D. N.J., No. 1:13-cv-05643 (NLH/AMD), June 27, 2014), a federal district judge ruled that an applicant’s claim against the State of New Jersey for denying Medicaid benefits based upon the purchase of an annuity survived a motion to dismiss even though the State reversed the denial because the applicant.. read more →

On June 23, 2014, the Government Accountability Office (GAO) released its report, Financial Characteristics of Approved Applicants and Methods Used to Reduce Assets to Qualify for Medicaid, which Sens. Tom Coburn (R-OK) and Richard Burr (R-NC) and Reps. Darrell Issa (R-CA) and Trey Gowdy (R-SC) requested. The GAO report confirmed that about 95% of approved.. read more →

In the May 19, 2014 J.P. v. Division of Medical Assistance and Health Services decision, New Jersey’s Appellate Division affirmed the final agency decision of the Director of the Division of Medical Assistance and Health Services (“DMAHS”), resulting in the imposition of a transfer penalty on the petitioner’s Medicaid application. After the ALJ had accepted the.. read more →

71st Semi-Annual Tax and Estate Planning Forum Our country is experiencing a growing number of households in which a parent and an adult child reside together. Census data reveals that the number of Americans living in multi-generational family households is the highest it has been since the 1950s, with a significant increase in recent years… read more →

A federal district court in New Jersey ruled that a Medicaid applicant was not entitled to a preliminary injunction to prevent the State from counting her annuity as an available resource. Matrangolo v. Velez (U.S. Dist. Ct., D. N.J., No. 13-6289 (MAS) (LHG), May 30, 2014). Plaintiff Marie Matrangolo, an 88-year-old woman who has been a.. read more →

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

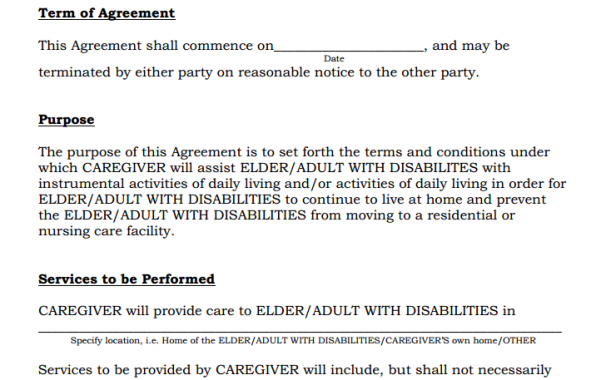

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media