New Jersey’s ABLE law (the acronym is short for “Achieving a Better Life Experience”) went into effect a few months ago, in October 2016. Under the new law, New Jersey’s Department of Human Services and the Department of the Treasury are required to establish the ABLE Program pursuant to federal law. Persons who became disabled.. read more →

In Simonsen v Bremby(2d Cir., No. 16-204-cv, Feb. 15, 2017), the daughter/Medicaid applicant filed suit in federal court and sought a preliminary injunction barring Medicaid from imposing a penalty period as a result of trusts established for her benefit by her mother. The two third-party trusts were considered as available resources by Medicaid, and when.. read more →

Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 8th Annual Senior Lawyers Conference given by the New Jersey Institute for Continuing Legal Education on April 3, 2017 at the New Jersey Law Center in New Brunswick, New Jersey. Mr. Vanarelli will provide an overview of elder law planning in New Jersey, including a discussion.. read more →

As 2007 began, Arthur Brown, who was then seventy-eight years old, and his wife, Mary, lived together in a jointly-owned condominium. Several months later, Arthur began living in an assisted living facility. The following year, Arthur was admitted into a nursing home after he was diagnosed with Alzheimer’s disease. Soon thereafter, Arthur applied for nursing.. read more →

A New York appeals court ruled that a Medicaid applicant successfully rebutted the presumption that transfers to her daughter made one and two years before entering a nursing home were for purposes other than to qualify for Medicaid, based on evidence that the money was used to help her grandson purchase a house. Matter of.. read more →

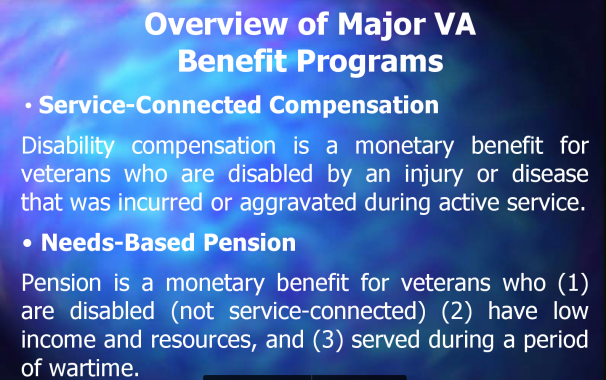

On November 15, 2016, I presented at the Second Annual Caring for Caregivers Conference at the East Rutherford Community Center. The first section of my presentation focused on guardianship law in New Jersey, Public Benefit Basics, and the use of special needs trusts by parents of adult disabled children. The powerpoint slides from the first part.. read more →

A U.S. district court denied a preliminary injunction to a Medicaid applicant who sued New Jersey to prevent the state from denying benefits based on her dead husband’s assets. Flade v. Connolly (U.S. Dist. Ct, D. N.J., No. 16-4407, Sept. 23, 2016). Plaintiff, Eileen Flade, was a nursing home resident. On April 12, 2016, plaintiff applied for.. read more →

Westfield, NJ – October 6, 2016 — Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will participate in the New Jersey State Bar Association’s Elder & Disability Law Section Roundtable Discussion on Medicaid Appeals to be held on October 13, 2016 at the New Jersey Law Center in New Brunswick, NJ. Mr. Vanarelli will present on “Appealing a.. read more →

Donald D. Vanarelli, Esq. to Moderate the Advanced Special Needs Trust Symposium

“Use of Special Needs Trusts in Cases Involving Divorce” to be presented by leading NJ Elder Law and Estate Planning Attorney, Donald D. Vanarelli, Esq., who will also act as Moderator of the Symposium Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will moderate and present at the Advanced Special Needs Trust Symposium given by the New Jersey Institute.. read more →

In this case, the Court considered whether a Medicaid applicant received full and fair notice of the reasons for the agency’s decision to deny benefits prior to holding a hearing on the applicant’s appeal. E.W. v. Cape May County Board of Social Service, OAL Docket. No. HMA 14667-15 (OAL December 24, 2015) In 2012, E.W.,.. read more →

A New York trial court entered judgment against a woman who refused to contribute to her spouse’s nursing home expenses, finding that because she had adequate resources to do so, an implied contract was created between her and the State of New York entitling the state to repayment of Medicaid benefits it paid on the.. read more →

In a recent opinion, an appellate court in Minnesota held that county officials were not liable for incorrectly telling a Medicaid applicant that his estate would not be subject to a Medicaid lien because the applicant could have hired a lawyer to learn the correct information. Benigni v. St. Louis County (Minn. Ct. App., No. A15-1154, June.. read more →

The Committee on the Unauthorized Practice of Law, appointed by the Supreme Court of New Jersey, recently issued Opinion 53 in which the Court considered weather non-lawyers who assisted applicants and beneficiaries in applying for Medicaid benefits were engaged in the unauthorized practice of law. The Court identified the non-lawyers providing Medicaid assistance as “Medicaid.. read more →

A New Jersey appeals court ruled that a Medicaid applicant’s daughter, who lived with her mother and provided care for 24 years before her mother was admitted to the nursing home, did not meet “caregiver child” exception to Medicaid’s transfer of assets rules because during that period care was provided by the applicant’s son for.. read more →

A New Jersey appeals court ruled that payments to the spouse of a Medicaid recipient from an annuity purchased with the spouse’s “resource allowance” were properly considered “income” to the spouse under the Medicaid rules. J.G. v. Division of Medical Assistance and Health Services J.G., who was married to M.G. for 67 years, suffered from Alzheimer’s.. read more →

The New York State Bar Association has issued a brochure to help consumers understand the benefits of utilizing an elder law attorney to assist (1) in the preparation of Medicaid applications and (2) in planning for yourself or a loved one to protect assets when seeking eligibility for public benefits based upon financial need. The.. read more →

In general, Medicaid rules impose periods of Medicaid ineligibility (“penalty periods”) when a Medicaid applicant makes gifts of assets in an attempt to qualify for Medicaid. If a Medicaid applicant gifts assets within the 60-month “look-back” period, the applicant may be subject to a Medicaid penalty period, based on the value of the gift. Notably,.. read more →

The Alzheimer’s Association has issued its 2016 Alzheimer’s Disease Facts and Figures report. The report is “a statistical resource for U.S. data related to Alzheimer’s disease, the most common cause of dementia, as well as other dementias.” Aside from providing a definition of Alzheimer’s disease (“Alzheimer’s disease is a degenerative brain disease and the most common cause of.. read more →

Medicaid, unlike Medicare, is a public benefit program based upon financial need. As a result, you are eligible for Medicaid only if you are over age 65, blind or disabled, and have few assets. If an applicant is married, all assets in the sole name of the husband, in the sole name of the wife, and.. read more →

A New Jersey appeals court held that a needs-based credit applied to the accounts of residents of an assisted living facility counts as income for Medicaid eligibility purposes. R.W. v. Division of Medical Assistance and Health Services (N.J. Super. Ct., App. Div., No. A-4911-13T1, Feb. 22, 2016). This case was brought by several residents of the.. read more →

After he was admitted to a nursing home in 2013, petitioner, R.P., accrued unpaid bills of $264,146 for nursing care services. As a result, three successive Medicaid applications were filed on R.P.’s behalf. It was undisputed that R.P. lacked the capacity to assist with any of the Medicaid applications. The first Medicaid application, filed in.. read more →

Top 10 Blog Posts on www.VanarelliLaw.com in 2015

Happy New Year to clients, supporters, friends and readers. Last month, an article on this blog ranked the 25 most popular blog posts and website articles on the Vanarelli Law Office website in 2015. Since then, I decided to narrow my focus a little. In this post, I focused solely on blog posts, and created.. read more →

Marie Brissette and her husband consulted attorney Edward Ryan for advice about how to protect their home from a Medicaid lien in the event that either needed long-term care. Ryan advised them to transfer the title to their property to their four adult children with reserved life estates. The Brissettes followed Ryan’s advice, transferring the.. read more →

An appeals court holds that the Massachusetts Medicaid is not required to recognize the reformation of an applicant’s trust after the original trust was considered an available asset. Needham v. Director of Medicaid (Mass. Ct. App., No. 14-P-182, Oct. 20, 2015). Maurice Needham, a Massachusetts resident, created two trusts. The first, a revocable trust, held the family.. read more →

In a 2 to 1 precedential decision by the United States Court of Appeals for the Third Circuit reversing an earlier federal district court judgment, the court ruled that “short-term annuities” purchased by applicants for nursing home Medicaid cannot be treated as an “available resource” that prevent Medicaid eligibility. Zahner v. Secretary, Pennsylvania Department of Human.. read more →

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media