The Social Security Administration (SSA) is proposing regulations which may make it more difficult for people who don’t speak English to qualify for disability benefits. Under planned regulations released February 01, 2019, the SSA would no longer consider a person’s “inability to communicate in English” when reviewing applications, both for Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) benefits. The.. read more →

In a recent decision, the U.S. Court of Appeals for the Federal Circuit ruled that the presumption of service-connection for certain diseases suffered by Vietnam War era veterans applied to so-called “blue water” veterans – those who served on ships in seas off the coast of Vietnam, but did not set foot on land. Procopio.. read more →

Social Security Disability Insurance (SSDI) is one of the major federal programs that provides monetary assistance to people with disabilities. Supplemental Security Income (SSI) is a federal program that helps people with disabilities and very low income and assets pay for food and shelter. SSDI is often confused with SSI. Although both programs pay benefits to.. read more →

The Department of Veterans Affairs (VA) needs-based pension program is available to compensate veterans for non-service-connected disabilities. Like the VA compensation program, eligibility for the pension program is based upon disability. Unlike the VA compensation program, however, the pension program is also based on income and financial need. To be eligible for benefits, the veteran’s.. read more →

New Jersey recently changed state law governing “refundable” entrance fee agreements used by Continuing Care Retirement Communities (CCRCs). State law limits the amount of time that CCRCs are permitted to retain “refundable” entrance fees after a resident vacates a facility due to relocation or death. Until recently, although New Jersey law required CCRCs to repay.. read more →

Westfield, NJ – June 19, 2018 — Donald D. Vanarelli, Esq. (https://vanarellilaw.com/) will participate in the New Jersey Institute for Continuing Legal Education’s 2018 Elder Law in a Day Seminar held on July 11, 2018 at the New Jersey Law Center in New Brunswick, NJ. Mr. Vanarelli will provide the “Case Law Update: The Year.. read more →

Public Law 113–295, also known as The Stephen Beck, Jr. Achieving a Better Life Experience Act (ABLE Act), was enacted December 19, 2014. The ABLE Act provides individuals with special needs and disabilities to save money for disability related expenses in tax-free savings accounts while preserving their needs-based government benefits. Modeled on 529 college savings plans, ABLE.. read more →

Trustees of special needs trusts are increasingly relying on “administrator-managed prepaid debit cards,” such as True Link cards, when disbursing funds to beneficiaries. These cards offer trust beneficiaries greater independence and the ability to get what they need more quickly. But such cards existed in a regulatory gray area as far as the Social Security.. read more →

The Stephen Komninos’ Law, enacted in 2017, went into effect on May 1, 2018. The new law is designed to protect individuals with developmental disabilities who receive services through the New Jersey Department of Human Services (DHS) from abuse, neglect, and exploitation by caregivers and others, to upgrade crimes committed against such individuals and to.. read more →

A New York end-of-life agency, named End Of Life Choices New York, has approved a new form of advance directive document that allows people to stipulate, in advance, that they don’t want food or water if they develop severe dementia. The new advance directive is called the “Advance Directive for Receiving Oral Food and Fluids in.. read more →

In October 2017, Congress passed an important new law, the Elder Abuse Prevention and Protection Act (EAPPA). The EAPPA is one of very few laws which allocates federal funds to address financial elder abuse. The new law was a direct reaction to increasing incidents of financial elder abuse. Every year, thieves, swindlers and even the.. read more →

The House Republicans tax proposal introduced today ends the Medical Expense Deduction. This change will cause major harm to individuals and families trying to pay for the catastrophic costs of long-term services and supports (LTSS). About half (52%) of Americans turning 65 today will develop a condition that requires LTSS. Individuals needing LTSS are those.. read more →

On September 13, 2017, Governor Christie signed legislation known as the “Uniform Fiduciary Access to Digital Assets Act.” In doing so, New Jersey joined 23 other states which have already have enacted a version of the law. The new law recognizes a fiduciary’s right to control a decedent’s digital assets. Under the new law, a.. read more →

In a major new ethics opinion, the American Bar Association’s Standing Committee on Ethics and Professional Responsibility indicated that lawyers must take reasonable efforts to ensure that communications with clients are secure and not subject to inadvertent or unauthorized security breaches. Notably, and for the first time, the opinion says that, in some circumstances, lawyers would.. read more →

New Jersey’s Medicaid rules are complicated, and always changing. One such change in the rules occurring on a regular basis is the State Medicaid agency’s amendment to the Medicaid program’s “penalty divisor.” On May 12, 2017, a Medicaid Communication, or notice from the agency, was released by New Jersey’s Division of Medical Assistance and Health.. read more →

New Jersey’s ABLE law (the acronym is short for “Achieving a Better Life Experience”) went into effect a few months ago, in October 2016. Under the new law, New Jersey’s Department of Human Services and the Department of the Treasury are required to establish the ABLE Program pursuant to federal law. Persons who became disabled.. read more →

New Jersey’s Division of Consumer Affairs (DCA) released a Consumer Brief on Medicaid Advisors/Application Assistors. Medicaid Advisors/Application Assistors are non-lawyers who provide limited services without payment or compensation in connection with Medicaid applications. According to the DCA Consumer Brief, the limited services which Medicaid Advisors/Application Assistors may perform include the following: providing information on insurance.. read more →

The Social Security Administration (SSA) published two final regulations that will have significant impacts on the disability determination process for those applying for Social Security Disability Insurance benefits and those applying for Supplemental Security Income (SSI) benefits on the basis of disability. The first set of regulations, Revisions to Rules Regarding the Evaluation of Medical.. read more →

The federal Nursing Home Reform Law was enacted in 1987, and became effective in October 1990. The Reform Law governs any nursing facility that accepts reimbursement from Medicare or Medicaid, and applies to all residents in any such facility, regardless of the individual resident’s payment source. In other words, the law applies whether the resident’s.. read more →

New Jersey lawmakers reached an agreement on Friday, September 30th which, among other things, will phase out New Jersey’s state estate tax. The New Jersey estate tax exemption, presently $675,000, will increase to $2 million after January 1, 2017. The estate tax will then be eliminated after January 1, 2018. An official vote on an estate.. read more →

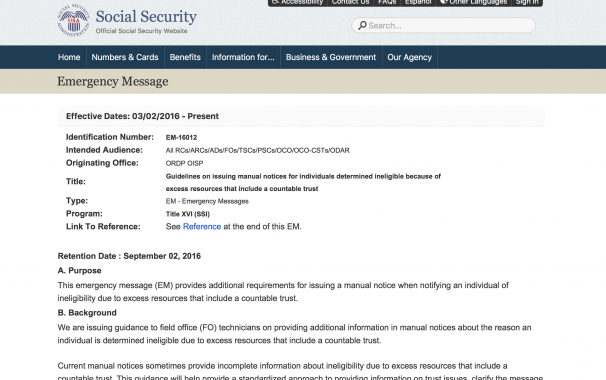

The Social Security Administration (SSA) recently published new guidelines mandating that the agency issue detailed notices when individuals are determined to be ineligible for Supplemental Security Income (SSI) benefits because of excess resources that include a countable trust. The public was notified of the new guidelines via internal agency instructions published in an Emergency Message… read more →

Below are figures for 2016 that are frequently used in the elder law practice or are of interest to clients. Medicaid Medicaid Spousal Impoverishment Figures for 2016 These figures are unchanged from 2015. The minimum community spouse resource allowance (CSRA) is $23,844 and the maximum CSRA remains $119,220. The maximum monthly maintenance needs allowance is $2,980.50. The minimum monthly.. read more →

(Donald D. Vanarelli, Esq. in the midst of oral argument before the New Jersey Supreme Court. A video of the entire oral argument can be found on Vanarelli & Li, LLC website.) ‘Elder and Disability Law Update’ and ‘Veteran Benefits Workshop’ to be presented by leading NJ Elder Law and Estate Planning Attorney, Donald D… read more →

In a recent press release, the Internal Revenue Service announced the release of proposed regulations implementing a new federal law authorizing states to offer tax-favored ABLE accounts to people with disabilities who became disabled before age 26. The Achieving a Better Life Experience (ABLE) legislation was signed into law in December 2014. ABLE accounts are.. read more →

After advocates criticized the Social Security Administration (SSA) for refusing to allow court-established Special Needs Trust to qualify as exempt resources for Supplemental Security Income (SSI) purposes, the SSA has issued an Administrative Message, AM-15032, clarifying its policy regarding these trusts. The Administrative Message explains that the rejection of court-established Special Needs Trust is appropriate.. read more →

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media