A nurse’s aide at a senior care facility in southern Minnesota posted a photograph of an elderly patient with on social media with a demeaning and vulgar message did not violate state law meant to protect patient privacy, a state court ruled. Furlow v. Madonna Summit of Byron, Docket No. A19-0987 (Minn. Ct. of Appeals,.. read more →

The decedent’s daughter had been disinherited under her mother’s 2013 Last Will and Testament. Following the decedent’s death, the daughter sought to admit a 2016 draft will, in which she was a beneficiary. The decedent had contacted her attorney beginning in 2015 regarding changes to her 2013 will, and advised the attorney that she did.. read more →

In December 2019, the U.S. Congress enacted into law the “Setting Every Community Up for Retirement Enhancement Act of 2019,” also known as the SECURE Act, as part of a year-end spending bill. The SECURE Act makes major changes to retirement plan rules, including inherited plans. The effective date for the new law is January.. read more →

Seniors and retirees may be able to use online tax preparation software free of charge. Most low- and middle-income Americans qualify for the free help, but do not take advantage of it. And all seniors are eligible for free counseling assistance from the IRS. The IRS Free File website links to the available free online tax.. read more →

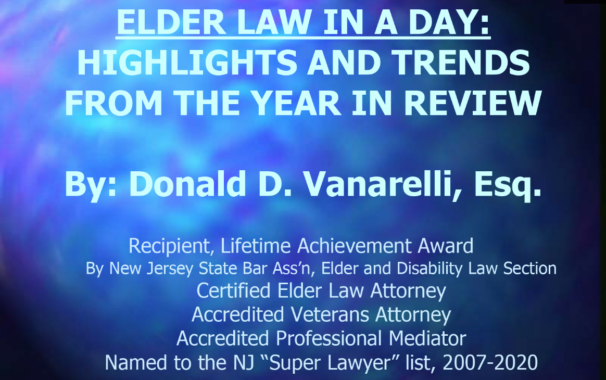

On January 29, 2020, I presented at the 2020 ““Elder Law in a Day” seminar given by the New Jersey Institute for Continuing Legal Education at the New Jersey Law Center in New Brunswick, New Jersey. I presented the case law update, summarizing the most significant legal developments over the past year in the areas.. read more →

A Massachusetts court held that the state is not entitled to recover Medicaid benefits from a community spouse’s annuity. Dermody v. The Executive Office of Health and Human Services (Mass. Super. Ct., No. 1781CV02342, Jan. 16, 2020). Robert Hamel purchased an annuity that named the state as primary beneficiary to the extent any Medicaid benefits are.. read more →

The patient was age 53 when he was transferred to Kindred Hospital. He had been diagnosed with multiple sclerosis and bipolar disorder in his twenties. When he signed the arbitration agreement in issue, he had required 24-hour nursing care for the previous 13 years, although he was not cognitively impaired at the time of the.. read more →

Based on reports from the local police department, Sussex County Division of Social Services, Adult Protective Services (“APS”) opened an investigation into the well-being of 85-year old Sally Dinoia, who was living with her son. Her son actively opposed the investigation, and his efforts included filing a federal complaint against APS and others involved in.. read more →

A fiduciary is a fancy legal term for the person who will take care of your property for you if you are unable to do it yourself, such as the executor of an estate, the trustee of a trust, or an attorney-in-fact under a power of attorney. Your first instinct might be to name one.. read more →

The decedent died without a will, and without a spouse, domestic partner, or children. Under the New Jersey laws of intestacy, if a decedent dies without a spouse or domestic partner, the decedent’s “descendants” inherit the estate. A “descendant” is defined to include a “child,” which in turn is defined as “any individual, including a.. read more →

The following figures represent the average cost of nursing home care in each region in New York State as determined by the State Department of Health. These figures are used to calculate Medicaid penalty periods for gifts and asset transfers in New York. Long Island (Nassau/Suffolk) $13,407 New York City (5 Boroughs) $12,844 Central (Syracuse,.. read more →

Involuntary Transfers Or Evictions To Another Care Facility “Difficult” residents are often subjected to involuntary eviction on the basis of the resident’s welfare, and that the resident’s needs cannot be met at the current nursing facility. As one commentator notes, “This type of argument is misplaced, however, because it only applies if the resident’s needs.. read more →

R.K. transferred her one-third interest in a house she owned jointly with her daughter and son-in-law to her daughter. Less than five years later, R.K. applied for Medicaid, and asserted that the transfer was exempt under Medicaid’s “caregiver child” exception to the rules prohibiting any transfers of assets within five years of the Medicaid application.. read more →

Revocable trusts are an effective way to avoid probate and provide for asset management in the event of incapacity. In addition, revocable trusts–sometimes called “living” trusts–are incredibly flexible and can achieve many other goals, including tax, long-term care, and asset-protection planning. A trust is a legal arrangement through which one person holds legal title to property.. read more →

The 2020 “Elder Law in a Day” Seminar: Learn How To Handle Elder Law Issues And Cases Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 2020 “Elder Law in a Day” seminar given by the New Jersey Institute for Continuing Legal Education on January 29, 2020 at the New Jersey Law Center, 1 Constitution.. read more →

H.R., who had significant cognitive and functional deficits, was admitted to the Hammonton Center for Rehabilitation and Healthcare (Hammonton Center). The Hammonton Center filed a complaint seeking the appointment of a guardian for H.R. While H.R.’s guardianship was still pending, the Hammonton Center filed a Medicaid application with the Atlantic County Board of Social Services.. read more →

Every year we release the key dollar amounts that are frequently used in elder law, estate administration and special needs trust planning, including Medicaid figures, Medicare premiums, Social Security Disability and Supplemental Security Income. Be sure to check back often, as we will add any information that has not yet been released and update the.. read more →

B.F. is an octogenarian who suffered a stroke causing left-side paralysis. B.F. used a wheelchair, and needed assistance with her activities of daily living (ADLs) and instrumental activities of daily living (IADLs). She lived with her long-time friend. When B.F. became eligible for Medicaid, she enrolled in the State’s then-existing Global Options for Long-Term Care.. read more →

The Nursing Home Reform Act of 1987 (“NHRA”) was enacted by Congress to provide “sweeping reform” in response to widespread issues of abuse, neglect, inadequate care, and general denial of residents’ basic rights in nursing facilities. Revised regulations for nursing facilities were released by the Centers for Medicare & Medicaid Services (“CMS”) in 2016. These.. read more →

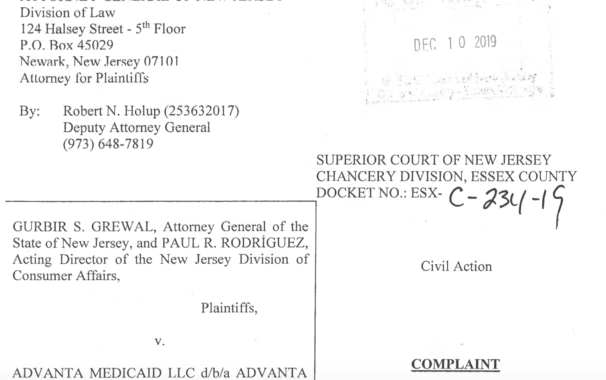

A company that was supposed to help consumers complete Medicaid applications for a fee stole more than $300,000 from clients, according to a lawsuit filed by the New Jersey attorney general and the state Division of Consumer Affairs. The State’s complaint, alleging violations of the Consumer Fraud Act, was filed in New Jersey Superior Court in.. read more →

P.P. had been his mother’s legal guardian, and he was executor of her estate. After her death, Medicaid asserted a statutory lien against her estate in the amount of $132,755, representing the amount of correctly paid medical assistance that had been paid on her behalf. P.P. requested a waiver or compromise of the lien based.. read more →

G.M., a 73 year old stroke victim, was diagnosed with Alzheimer’s disease, vascular dementia, schizoaffective and bipolar disorders. After G.M. filed a Medicaid application, the Atlantic County Board of Social Services (Board) notified G.M. that his application was denied because he did not provide necessary information. Several months later, G.M.’s designated authorized representative (DAR) submitted.. read more →

On November 20, 2019, I presented at the 2019 “The Medical Side of Elder Law” seminar given by the New Jersey Institute for Continuing Legal Education at the Hilton/Doubletree Hotel in Fairfield, New Jersey. I presented an overview of the rights of residents of nursing homes and other care facilities under federal and state laws.. read more →

The issue in this appeal is whether a widow can modify the retirement application of her recently deceased husband, who was a member of the Teachers’ Pension and Annuity Fund (Pension Fund), even though his application was never approved because he selected a retirement option for which he was ultimately ineligible. David and Christine Minsavage.. read more →

The Internal Revenue Service (IRS) has announced the amount taxpayers can deduct from their 2020 income as a result of buying long-term care insurance. Premiums for “qualified” long-term care insurance policies are tax deductible for the taxpayer, his or her spouse and other dependents to the extent that the premiums, along with other unreimbursed medical expenses.. read more →

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media