Upcoming Webinar: Planning for Your Child With Special Needs

Upcoming FREE Webinar: REGISTER TODAY Date: Thursday, May 18, 2023 at 4:00 PM EST (Approximately 2 hours, depending on Q & A) Learn to Utilize Special Needs Trusts and ABLE Accounts to Access Medicaid, SSI, DDD Services and Other Public Benefits to Plan for the Future of Your Child With Special Needs Attorneys Donald D… read more →

This latest edition of Law Points for Senior Citizens, the 4th edition, is published by the New Jersey State Bar Foundation as a public service to explain laws in New Jersey of special interest to senior citizens. The booklet explains laws governing a variety of topics, such as Social Security retirement benefits, Medicaid and nursing.. read more →

PowerPoint Slides on Protecting your Assets from the Catastrophic Costs of Nursing Homes and other Long-Term Care Facilities

On October 15, 2020, Attorney Donald D. Vanarelli, Esq. presented a live Webinar in which attendees learned how to Protect their Assets from the Catastrophic Costs of Probate, Long-Term Care and Nursing Home Expenses. Webinar Topics Included: Care options and typical costs of care in New Jersey in various settings. How to qualify for government.. read more →

IRS Issues Final Regulations For Achieving A Better Life Experience (ABLE) Accounts

The Internal Revenue Service issued final regulations this month providing details about how Achieving a Better Life Experience (ABLE) accounts should operate. ABLE accounts are designed to help people with disabilities and their families save up to $100,000 without risking eligibility for Supplemental Security Income (SSI) and other government benefits based on financial need. Medicaid can.. read more →

On September 19, 2019, I presented at the 2019 Fall Conference given by the Aging Life Care Association (Formerly the National Association of Professional Geriatric Care Managers) at the Asbury Hotel in Asbury Park, New Jersey. My presentation was an overview of the various types of irrevocable trusts used by elder law and special needs planning.. read more →

On April 26, 2019, the U.S. Department of Housing and Urban Development (HUD) issued a Notice to state housing agencies concerning the impact of ABLE accounts on eligibility for Section 8 vouchers, public housing and a host of other federal housing programs. ABLE accounts were created in 2014 by the passage of the Achieving a.. read more →

The Achieving a Better Life Experience (ABLE) Act allows people with disabilities who became disabled before they turned 26 to set aside up to $15,000 per year in tax-free savings accounts without affecting his or her eligibility for government benefits like Medicaid and Supplemental Security Income (SSI). This money can come from the disabled individual.. read more →

Our law firm has created a number of Legal Guides for our clients and website guests to provide a better understanding of important and oftentimes complex legal subjects. The Legal Guides are offered free of charge. One of the Legal Guides available to the public discusses Special Needs Trusts and Special Needs Planning. Parents of children.. read more →

Upcoming Presentation on Special Needs Planning and Special Needs Trusts for Community Access Unlimited

Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will provide an overview of the use of Special Needs Trusts (SNTs) by disabled persons so as to prevent an applicant’s financial assets and income from impacting eligibility for needs-based public benefits such as Supplemental Security Income (SSI), Medicaid, services from the Division of Developmental Disabilities (DDD), Section 8 Housing and.. read more →

New Jersey’s ABLE law (the acronym is short for “Achieving a Better Life Experience”) went into effect a few months ago, in October 2016. Under the new law, New Jersey’s Department of Human Services and the Department of the Treasury are required to establish the ABLE Program pursuant to federal law. Persons who became disabled.. read more →

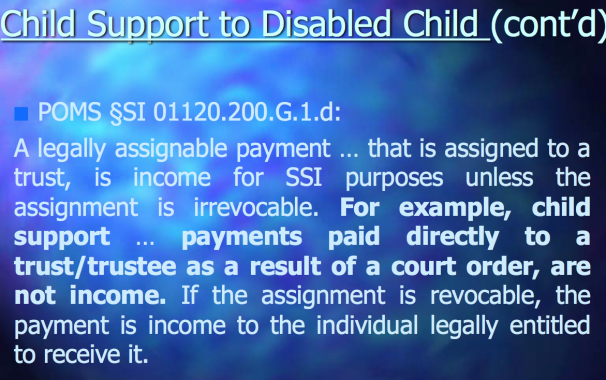

Special Needs Trusts and Divorce / Part 2: Child Support

(On December 1, 2016, I moderated the first Advanced Special Needs Trust Symposium, an all-day event held at the New Jersey Law Center. In addition to moderating the panel of speakers, I also presented on the topic of the “Uses of Special Needs Trusts in Cases Involving Divorce.” Due to the length of my paper,.. read more →

Special Needs Trusts and Divorce / Part 1: Alimony and Property Settlement Agreements

(On December 1, 2016, I moderated the first Advanced Special Needs Trust Symposium, an all-day event held at the New Jersey Law Center. In addition to moderating the panel of speakers, I also presented on the topic of the “Uses of Special Needs Trusts in Divorce.” Due to the length of my paper, I divided.. read more →

Donald D. Vanarelli, Esq. to Moderate the Advanced Special Needs Trust Symposium

“Use of Special Needs Trusts in Cases Involving Divorce” to be presented by leading NJ Elder Law and Estate Planning Attorney, Donald D. Vanarelli, Esq., who will also act as Moderator of the Symposium Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will moderate and present at the Advanced Special Needs Trust Symposium given by the New Jersey Institute.. read more →

Reversing a federal district court, the U.S. Court of Appeals for the First Circuit ruled that a state housing authority cannot count distributions from a special needs trust as income in determining eligibility under the Section 8 housing voucher program. DeCambre v. Brookline Housing Authority (1st Cir., Nos. 15-1458, 15-1515, June 14, 2016). Kimberly DeCambre, a disabled,.. read more →

A federal district court ruled that a public housing authority properly counted distributions from a special needs trust as income in concluding that the beneficiary of the trust was ineligible for a Section 8 housing voucher. DeCambre v. Brookline Housing Authority (D. Mass., No. 14-13425-WGY, March 25, 2015) Kimberly DeCambre, a disabled, 59 year old resident.. read more →

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media