The Centers for Medicare and Medicaid Services, the Department of Veterans Affairs (VA), the Social Security Administration and other state and federal agencies have released the following important numbers for 2017. MEDICARE Medicare Part A deductible: $1316 for each benefit period. Medicare Part A co-payments for hospital stays: Day 1-60: $0 co-payment for each benefit.. read more →

A step-by-step guide to initiating a guardianship action in New Jersey follows. Documents To Be Filed: A guardianship action is initiated by submitting the following documents to the Surrogate for filing, with the required filing fee: Order Fixing Guardianship Hearing Verified Complaint Certification of Assets Certifications of Physician or Psychologist Case Information Statement Each of.. read more →

Question: Will the Department of Veterans Affairs (VA) recognize the cost of care provided by an unlicensed caregiver as an expense in determining the financial eligibility of an applicant for VA pension benefits? Answer: The VA WILL recognize the cost of care provided by an unlicensed caregiver as an allowable expense in determining the financial eligibility.. read more →

Powers of Attorney are common but often misunderstood estate documents in New Jersey and other states. A power of attorney is a legal document. When you sign a power of attorney, you appoint another person to serve as your agent (or “attorney-in-fact”). Legally, there are many duties and responsibilities imposed on an agent under a.. read more →

Last year, the National Senior Citizens Law Center (NSCLC), an important voice for low-income seniors for the past 43 years, launched a new name and tagline—Justice in Aging: Fighting Senior Poverty Through Law. The focus of the organization continues to be advocacy and litigation to secure the rights of low-income seniors, and education and training of advocates.. read more →

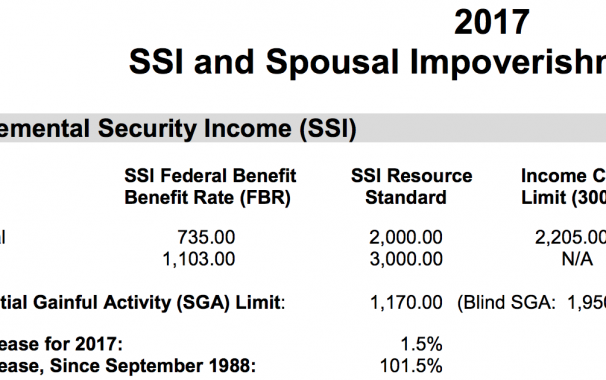

The Centers for Medicare and Medicaid Services has released its SSI and Spousal Impoverishment Standards for 2017. SUPPLEMENTAL SECURITY INCOME (SSI) SSI Federal Benefit Rate for an Individual: $735.00 SSI Federal Benefit Rate for a Couple: $1,103.00 Substantial Gainful Activity (SGA) Limit: $1,170.00 (Blind SGA: $1,950.00) MEDICAID Minimum Community Spouse Resource Allowance: $24,180 Maximum Community Spouse.. read more →

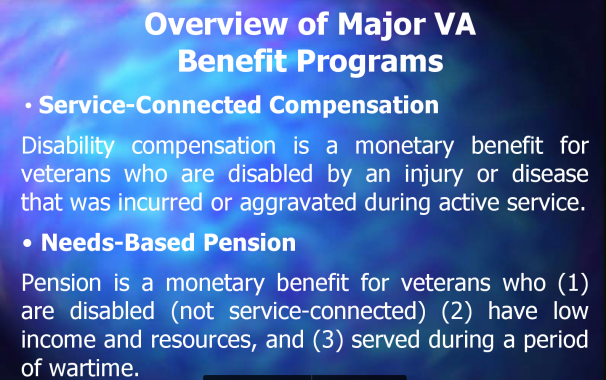

On November 15, 2016, I presented at the Second Annual Caring for Caregivers Conference at the East Rutherford Community Center. The first section of my presentation focused on guardianship law in New Jersey, Public Benefit Basics, and the use of special needs trusts by parents of adult disabled children. The powerpoint slides from the first part.. read more →

On November 15, 2016, I presented at the Second Annual Caring for Caregivers Conference at the East Rutherford Community Center. The first section of my presentation focused on guardianship law in New Jersey, Public Benefit Basics, and the use of Special Needs Trusts by parents of adult disabled children. The powerpoint slides I prepared for.. read more →

East Rutherford’s Access for All Committee Hosts the Second Annual Caring for Caregivers Conference on Tuesday, November 15, 2016, from 5:30 to 8:00 p.m. at the East Rutherford Community Center. At the upcoming Caring for Caregivers Conference, caregivers will be provided with critical information and resources that support the needs of their special needs or.. read more →

President Obama has proclaimed November 2016 as National Alzheimer’s Disease Awareness Month. The President has called upon the people of the United States “to learn more about Alzheimer’s disease and support the individuals living with this disease and their caregivers.” Alzheimer’s disease is an irreversible, progressive brain disorder that slowly destroys memory and thinking skills.. read more →

Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 2016 Elder Law College given by the New Jersey Institute for Continuing Legal Education on December 14, 2016 at the Crowne Plaza, located at 690 Route 46 East, Fairfield, New Jersey. Mr. Vanarelli will provide an overview of New Jersey law concerning guardianships and conservatorships. For.. read more →

Medicare’s annual open enrollment period runs from October 15 to December 7–the period when enrollees can shop for new coverage. Now is the time to review your options to determine if you should switch plans. During Medicare’s annual open enrollment period, you may (1) enroll in a Medicare Part D (prescription drug) plan; (2) change your Part.. read more →

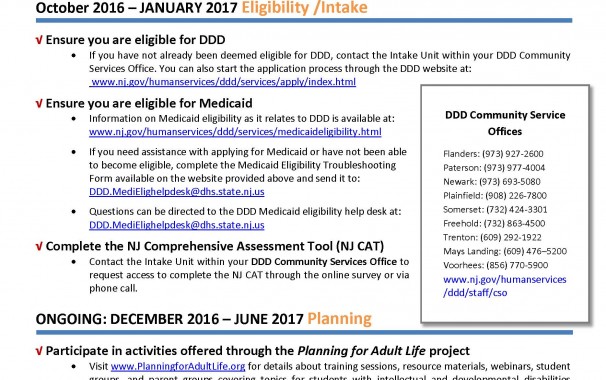

“Graduates Timeline” Helps Students with Intellectual and Developmental Disabilities Transition from School to Adulthood New Jersey’s Division of Developmental Disabilities, an agency within the Department of Human Resources, provides public funding for services and supports that assist New Jersey adults with intellectual and developmental disabilities who are aged 21 and older to live as independently as possible. The.. read more →

Westfield, NJ – October 6, 2016 — Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will participate in the New Jersey State Bar Association’s Elder & Disability Law Section Roundtable Discussion on Medicaid Appeals to be held on October 13, 2016 at the New Jersey Law Center in New Brunswick, NJ. Mr. Vanarelli will present on “Appealing a.. read more →

New Jersey lawmakers reached an agreement on Friday, September 30th which, among other things, will phase out New Jersey’s state estate tax. The New Jersey estate tax exemption, presently $675,000, will increase to $2 million after January 1, 2017. The estate tax will then be eliminated after January 1, 2018. An official vote on an estate.. read more →

Question: Does a Section 529 educational savings plan account impact the eligibility of a minor receiving Supplemental Security Income (SSI) benefits? Are there any regulations governing such plans? Answer: Qualified Tuition Programs (QTPs), also referred to as Section 529 educational savings plans, allow individuals to contribute to an account established to pay a designated beneficiary’s.. read more →

The Supreme Court of Virginia ruled that an attorney who drafted a client’s Last Will and Testament may be sued for legal malpractice by a beneficiary of the will even though the beneficiary of the will is not the attorney’s client. Thorsen v. Richmond Society for the Prevention of Cruelty to Animals (Va., No. 150528,.. read more →

I just read an insightful article in the Washington Post. The article, by Susan Berger, asks the question: “What’s the best way to talk to someone with Alzheimer’s?” It stems from an encounter between Berger and an acquaintance of hers who had just been diagnosed with the disease. The article explores what to do and.. read more →

The Committee on the Unauthorized Practice of Law, appointed by the Supreme Court of New Jersey, recently issued Opinion 53 in which the Court considered weather non-lawyers who assisted applicants and beneficiaries in applying for Medicaid benefits were engaged in the unauthorized practice of law. The Court identified the non-lawyers providing Medicaid assistance as “Medicaid.. read more →

Vanarelli & Li, LLC provides Special Needs Trusts and Disability Planning Attorney Services throughout the State of New Jersey. See: https://vanarellilaw.com/special-needs-disability-planning/ Elder Law topics covered in this video include Guardianships, Conservatorships, Power of Attorney, Representative Payeeships (SSA and SSI), Joint Tenancies (including joint bank accounts), Advance Medical Directives (living wills), Do Not Resuscitate (DNR).. read more →

The mission of the Academy of Special Needs Planners (ASNP) is to maintain a professional organization of attorneys skilled in the complex areas of public entitlements, estate, trust and tax planning, and the legal issues involving individuals with physical and cognitive disabilities. The ASNP recently announced the addition of a new brochure titled “10 Costly Mistakes.. read more →

The New York State Bar Association has issued a brochure to help consumers understand the benefits of utilizing an elder law attorney to assist (1) in the preparation of Medicaid applications and (2) in planning for yourself or a loved one to protect assets when seeking eligibility for public benefits based upon financial need. The.. read more →

In general, Medicaid rules impose periods of Medicaid ineligibility (“penalty periods”) when a Medicaid applicant makes gifts of assets in an attempt to qualify for Medicaid. If a Medicaid applicant gifts assets within the 60-month “look-back” period, the applicant may be subject to a Medicaid penalty period, based on the value of the gift. Notably,.. read more →

The Alzheimer’s Association has issued its 2016 Alzheimer’s Disease Facts and Figures report. The report is “a statistical resource for U.S. data related to Alzheimer’s disease, the most common cause of dementia, as well as other dementias.” Aside from providing a definition of Alzheimer’s disease (“Alzheimer’s disease is a degenerative brain disease and the most common cause of.. read more →

Medicaid, unlike Medicare, is a public benefit program based upon financial need. As a result, you are eligible for Medicaid only if you are over age 65, blind or disabled, and have few assets. If an applicant is married, all assets in the sole name of the husband, in the sole name of the wife, and.. read more →

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media