A New Jersey appeals court ruled that a Medicaid applicant’s daughter, who lived with her mother and provided care for 24 years before her mother was admitted to the nursing home, did not meet “caregiver child” exception to Medicaid’s transfer of assets rules because during that period care was provided by the applicant’s son for.. read more →

Government Long-Term Care Benefits for NJ Residents 908-232-7400 Vanarelli & Li, LLC provides comprehensive Government Long-Term Care Benefits Legal Services throughout the State of New Jersey. See: https://vanarellilaw.com/medicaid-public-benefits-planning/ Elder Law topics covered in the video include Eligibility for Medicaid, Income and Resource Limits and Caps, Medicare Coverage, Home Health Aides, Home Health Care, Nursing Home.. read more →

I represented the 84-year old petitioner in P.R.-P. v. United Healthcare , a case in which we successfully appealed the reduction in her Medicaid personal care assistant (“PCA”) hours. The petitioner suffers from advanced Alzheimer’s disease, coronary artery disease, diabetes, congestive heart failure, kidney failure, renal failure, blindness, and bladder incontinence, among other things. She.. read more →

A New Jersey appeals court ruled that payments to the spouse of a Medicaid recipient from an annuity purchased with the spouse’s “resource allowance” were properly considered “income” to the spouse under the Medicaid rules. J.G. v. Division of Medical Assistance and Health Services J.G., who was married to M.G. for 67 years, suffered from Alzheimer’s.. read more →

In this case, a New Jersey appeals court held that a disabled New Jersey resident eligible for Personal Care Assistance (PCA) services since 2009 was no longer eligible for PCA services under the Medicaid requirements. J.R. v. Division of Medical Assistance and Health Services, Docket No. A-0648-14T3 (App. Div., April 18, 2016 J.R. was diagnosed.. read more →

The New York State Bar Association has issued a brochure to help consumers understand the benefits of utilizing an elder law attorney to assist (1) in the preparation of Medicaid applications and (2) in planning for yourself or a loved one to protect assets when seeking eligibility for public benefits based upon financial need. The.. read more →

In general, Medicaid rules impose periods of Medicaid ineligibility (“penalty periods”) when a Medicaid applicant makes gifts of assets in an attempt to qualify for Medicaid. If a Medicaid applicant gifts assets within the 60-month “look-back” period, the applicant may be subject to a Medicaid penalty period, based on the value of the gift. Notably,.. read more →

The Alzheimer’s Association has issued its 2016 Alzheimer’s Disease Facts and Figures report. The report is “a statistical resource for U.S. data related to Alzheimer’s disease, the most common cause of dementia, as well as other dementias.” Aside from providing a definition of Alzheimer’s disease (“Alzheimer’s disease is a degenerative brain disease and the most common cause of.. read more →

Medicaid, unlike Medicare, is a public benefit program based upon financial need. As a result, you are eligible for Medicaid only if you are over age 65, blind or disabled, and have few assets. If an applicant is married, all assets in the sole name of the husband, in the sole name of the wife, and.. read more →

A New Jersey appeals court held that a needs-based credit applied to the accounts of residents of an assisted living facility counts as income for Medicaid eligibility purposes. R.W. v. Division of Medical Assistance and Health Services (N.J. Super. Ct., App. Div., No. A-4911-13T1, Feb. 22, 2016). This case was brought by several residents of the.. read more →

The New Jersey Law Revision Commission (“NJLRC”) is an independent legislative commission of the State that engages in an ongoing review of statutes and case law, in order to remedy defects and clarify confusing language in those statutes. The NJLRC is proposing a revision to the New Jersey statutes in order to codify the Supreme.. read more →

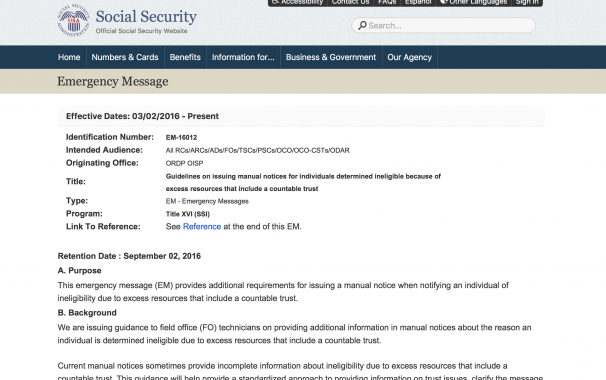

The Social Security Administration (SSA) recently published new guidelines mandating that the agency issue detailed notices when individuals are determined to be ineligible for Supplemental Security Income (SSI) benefits because of excess resources that include a countable trust. The public was notified of the new guidelines via internal agency instructions published in an Emergency Message… read more →

After he was admitted to a nursing home in 2013, petitioner, R.P., accrued unpaid bills of $264,146 for nursing care services. As a result, three successive Medicaid applications were filed on R.P.’s behalf. It was undisputed that R.P. lacked the capacity to assist with any of the Medicaid applications. The first Medicaid application, filed in.. read more →

M.S. is a 73-year old residing in at a long-term care facility. She is a hemiplegic who suffers from obesity, diabetes, arthritis, osteoporosis and COPD. Because she is completely paralyzed on her left side, she had been using a manual one-arm wheelchair. She filed an application to the Division of Medical Assistance and Health Services.. read more →

Below are figures for 2016 that are frequently used in the elder law practice or are of interest to clients. Medicaid Medicaid Spousal Impoverishment Figures for 2016 These figures are unchanged from 2015. The minimum community spouse resource allowance (CSRA) is $23,844 and the maximum CSRA remains $119,220. The maximum monthly maintenance needs allowance is $2,980.50. The minimum monthly.. read more →

As explained in previous blog posts here, here and here, an Achieving a Better Life Experience (ABLE) account is a tax-advantaged account that can be used to save funds for the disability-related expenses of the account’s designated beneficiary, who must be blind or disabled by a condition that began prior to the individual’s 26th birthday… read more →

In this case, a Medicaid application filed by the beneficiary of a special needs trust was denied by the Medicaid agency and upheld on appeal because the special needs trust, funded with the proceeds from a personal injury lawsuit but lacking a Medicaid payback provision, violated applicable law. D.W. v. Division of Medical Assistance and Health Services (N.J… read more →

Marie Brissette and her husband consulted attorney Edward Ryan for advice about how to protect their home from a Medicaid lien in the event that either needed long-term care. Ryan advised them to transfer the title to their property to their four adult children with reserved life estates. The Brissettes followed Ryan’s advice, transferring the.. read more →

A court in Connecticut ruled that the administrator of an estate lacked standing to appeal the denial of an application for Medicaid benefits because no appeal of the denial was filed before the decedent died. Freese v. Department of Social Services (Conn. Super. Ct., No. CV14-6047417S, June 1, 2015). Plaintiff, Kathleen Freese, claimed that the defendant, Department.. read more →

The Social Security Administration (SSA) requires periodic reports from all recipients of Supplemental Security Income (SSI) benefits. If the SSI recipient has a representative payee, the payee is obligated to make the report. Recipients who are legally incompetent are not responsible for reporting, but their payees are. Required reports must be completed in order for eligibility for SSI benefits.. read more →

An appeals court holds that the Massachusetts Medicaid is not required to recognize the reformation of an applicant’s trust after the original trust was considered an available asset. Needham v. Director of Medicaid (Mass. Ct. App., No. 14-P-182, Oct. 20, 2015). Maurice Needham, a Massachusetts resident, created two trusts. The first, a revocable trust, held the family.. read more →

The decedent, Tracy Solivan, had been disabled at birth as a result of medical malpractice at a Hudson County hospital. Her parents had obtained a $172,400 settlement on her behalf, which was held in the Hudson County Surrogate’s account until she turned eighteen. In 2002, after she turned 18, Tracy Solivan’s mother was appointed as.. read more →

The decision by respondent, United Healthcare, a managed care organization, to reduce the Personal Care Assistant (PCA) hours awarded to petitioner, C.S., from forty (40) hours per week to twenty-five (25) hours per week was reversed on appeal. C.S. v. United Healthcare, 2015 WL 4410104 (June 4, 2015, N.J. Adm.) C.S. is eighty-eight (88) years old. She began.. read more →

In a 2 to 1 precedential decision by the United States Court of Appeals for the Third Circuit reversing an earlier federal district court judgment, the court ruled that “short-term annuities” purchased by applicants for nursing home Medicaid cannot be treated as an “available resource” that prevent Medicaid eligibility. Zahner v. Secretary, Pennsylvania Department of Human.. read more →

The Superior Court of New Jersey, Appellate Division, affirmed a decision of the Director of New Jersey Medicaid reversing a ruling of an Administrative Law Judge (ALJ) who reduced C.W.’s Medicaid ineligibility penalty previously assessed for transferring assets for less than fair market value. C.W. v. Division of Medical Assistance and Health Services, Docket No. A-2352-13T2.. read more →

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media