Two recent cases are vivid reminders that blogging can be dangerous. Bloggers are being found legally accountable and financially liable for their online postings. The take-away is clear: bloggers, beware: what you write can get you sued, or disbarred. Blogger Found Liable for $600,000 in Defamation Case A libel lawsuit was filed in Georgia by.. read more →

In this will contest involving the doctrine of probable intent, Hon. Robert P. Contillo, P.J.Ch. ruled that a court cannot alter the language of a trust that is plain and unambiguous even when extrinsic evidence strongly suggests that the trust language is not what the settlor intended. Violet and Joseph Nelson had three children: Jacob.. read more →

In 1997, the decedent, Kathleen Boyer, executed a Last Will and Testament and a revocable trust. In the will, she directed that her residuary estate “pour over” into the revocable trust upon her death. She named herself as trustee of the revocable trust and, although she retained complete control of the trust assets during her.. read more →

After he was admitted to a nursing home in 2013, petitioner, R.P., accrued unpaid bills of $264,146 for nursing care services. As a result, three successive Medicaid applications were filed on R.P.’s behalf. It was undisputed that R.P. lacked the capacity to assist with any of the Medicaid applications. The first Medicaid application, filed in.. read more →

A Florida appeals court upheld a judgment of $350,000 in a lawsuit filed by a lawyer against her former client alleging defamation based on negative reviews of the lawyer posted on the internet by the former client. Blake v. Giustibelli, __ So.3d __ (Fla. 4th DCA, No. 4D14-3231, 1/6/2016), 2016 WL _______. Florida Attorney Ann-Marie.. read more →

M.S. is a 73-year old residing in at a long-term care facility. She is a hemiplegic who suffers from obesity, diabetes, arthritis, osteoporosis and COPD. Because she is completely paralyzed on her left side, she had been using a manual one-arm wheelchair. She filed an application to the Division of Medical Assistance and Health Services.. read more →

Top 10 Blog Posts on www.VanarelliLaw.com in 2015

Happy New Year to clients, supporters, friends and readers. Last month, an article on this blog ranked the 25 most popular blog posts and website articles on the Vanarelli Law Office website in 2015. Since then, I decided to narrow my focus a little. In this post, I focused solely on blog posts, and created.. read more →

The New Jersey Achieving a Better Life Experience (ABLE) Act became law today. Under the new Act, New Jersey’s Department of Human Services and the Department of the Treasury are required to establish the ABLE Program pursuant to federal law. Under the program, persons who became disabled before age 26 and are found to meet.. read more →

Daughter/Executrix Who Disputed Terms of Mother’s Will is Denied Commissions

Linda Hall was the executrix of her mother’s estate. Hall had initially had a 2005 will admitted to probate. When Hall’s sister, Carol Polak-Reid (“Reid”) filed a complaint alleging that their mother had executed another will in 2011, Hall represented that she had attempted to have the 2011 will admitted, but the surrogate had rejected.. read more →

Medicare beneficiaries may now discuss options for end-of-life care with their health care providers. Beneficiaries were always free to talk about advance care planning with their doctors or other qualified health professionals. Unfortunately, however, until recently practitioners could be reimbursed for such discussions only during a patient’s “Welcome to Medicare” visit. Under new regulations effective.. read more →

Below are figures for 2016 that are frequently used in the elder law practice or are of interest to clients. Medicaid Medicaid Spousal Impoverishment Figures for 2016 These figures are unchanged from 2015. The minimum community spouse resource allowance (CSRA) is $23,844 and the maximum CSRA remains $119,220. The maximum monthly maintenance needs allowance is $2,980.50. The minimum monthly.. read more →

Here’s wishing all of you, your families and loved ones a successful, fulfilling and happy new year, with plenty of good luck, good friends and good eating too! read more →

Happy New Year to clients, supporters, friends and readers. To celebrate the new year, we’ve ranked our most popular blog posts and website articles from this past year. For blog posts, the original post date is included after each hyperlinked title. Check out the list to see this year’s highlights and tell us what you’d.. read more →

A lawyer who was found to have exerted undue influence over his mother must reimburse her estate for legal fees and costs, along with paying prejudgment interest from the date the estate monies were wrongfully taken, an appeals court ruled. Matter of the Estate of Sogliuzzo, Docket No. A-0882-14T2 (App. Div., December 17, 2015) Jane P… read more →

As explained in previous blog posts here, here and here, an Achieving a Better Life Experience (ABLE) account is a tax-advantaged account that can be used to save funds for the disability-related expenses of the account’s designated beneficiary, who must be blind or disabled by a condition that began prior to the individual’s 26th birthday… read more →

In 2003, Michael Yahatz opened a bank account. The following year, the bank was acquired by Bank of America (“BOA”) and the account was converted to a money market account. In 2005, Mr. Yahatz signed a BOA signature card, which included an acknowledgement that the account would be governed by BOA’s deposit agreement. The deposit.. read more →

Under the New Jersey laws of intestacy, if a decedent dies without a will and without a spouse or children, his or her parents will share equally in his/her intestate estate. N.J.S.A. 3B:5-4(b). However, effective July 1, 2009, a New Jersey statute prevents surviving parents from sharing in a child’s intestate estate if the parent,.. read more →

In this case, a Medicaid application filed by the beneficiary of a special needs trust was denied by the Medicaid agency and upheld on appeal because the special needs trust, funded with the proceeds from a personal injury lawsuit but lacking a Medicaid payback provision, violated applicable law. D.W. v. Division of Medical Assistance and Health Services (N.J… read more →

In many divorce cases, when a one spouse or parent is not reporting his or her true income, or is unemployed or underemployed and not earning what he or she could, the court may impute income to that spouse so the proper amount of spousal or child support is paid to the other divorcing spouse… read more →

In this case, a surviving spouse’s claim to her deceased spouse’s life insurance proceeds was rejected by an appeals court in New Jersey because the deceased spouse named others as beneficiaries. Fromageot v. Fromageot, Docket No. A-1099-13T1 (App. Div., December 2, 2015) The decedent, Paul Fromageot (“Paul”), had two life insurance policies. One was a.. read more →

Disability benefits are available to claimants under both disability benefit programs established under the Social Security Act (the “Act”), i.e., the regular Social Security disability program under Title II of the Act, and the Supplemental Security Income program under Title XVI of the Act. Social Security Disability (“SSD”) Benefits: Social Security Disability benefits are available.. read more →

Marie Brissette and her husband consulted attorney Edward Ryan for advice about how to protect their home from a Medicaid lien in the event that either needed long-term care. Ryan advised them to transfer the title to their property to their four adult children with reserved life estates. The Brissettes followed Ryan’s advice, transferring the.. read more →

A court in Connecticut ruled that the administrator of an estate lacked standing to appeal the denial of an application for Medicaid benefits because no appeal of the denial was filed before the decedent died. Freese v. Department of Social Services (Conn. Super. Ct., No. CV14-6047417S, June 1, 2015). Plaintiff, Kathleen Freese, claimed that the defendant, Department.. read more →

In a case of first impression, a trial judge in Ocean County ruled that victims of domestic elder abuse can use New Jersey’s Prevention of Domestic Violence Act to obtain restraining orders against their abusers. J.C. v. B.S., Docket No. FV-15-352-16 (Chan. Div., Family Part, Ocean County, September 14, 2015) In an unpublished opinion, Superior.. read more →

The Social Security Administration (SSA) requires periodic reports from all recipients of Supplemental Security Income (SSI) benefits. If the SSI recipient has a representative payee, the payee is obligated to make the report. Recipients who are legally incompetent are not responsible for reporting, but their payees are. Required reports must be completed in order for eligibility for SSI benefits.. read more →

On March 9, 2015, I blogged about an Appellate Division case holding that marriage does not create a presumptive right to a deceased spouse’s life insurance benefits. That blog can be found here. In In re Estate of Matchuk, the Appellate Division extended that holding to funds in a deceased spouse’s retirement accounts. In Matchuk,.. read more →

An appeals court holds that the Massachusetts Medicaid is not required to recognize the reformation of an applicant’s trust after the original trust was considered an available asset. Needham v. Director of Medicaid (Mass. Ct. App., No. 14-P-182, Oct. 20, 2015). Maurice Needham, a Massachusetts resident, created two trusts. The first, a revocable trust, held the family.. read more →

The decedent, Tracy Solivan, had been disabled at birth as a result of medical malpractice at a Hudson County hospital. Her parents had obtained a $172,400 settlement on her behalf, which was held in the Hudson County Surrogate’s account until she turned eighteen. In 2002, after she turned 18, Tracy Solivan’s mother was appointed as.. read more →

In this case, an Ocean County judge ruled that litigants in domestic violence cases who want to introduce evidence contained on their cell phones, such as texts, emails, social media messages, or audio/visual evidence, must first provide such evidence to the court and the adversary in tangible form, such as on a printout or a.. read more →

After plaintiffs lost the money they had invested in what turned out to be a Ponzi scheme, they sued the attorney who represented the Ponzi scheme operator. The Ponzi scheme operator, Antoinette Hodgson, had claimed to own a real estate investment business. During the time period in which the plaintiffs invested with Hodgson, the defendant.. read more →

Medicare is the federal government’s principal health care insurance program for people 65 years of age and over. In addition, the program covers people of any age who are permanently disabled or who have end-stage renal disease (people with kidney ailments that require dialysis or a kidney transplant). The Medicare program insures 49 million Americans.. read more →

The 18th Annual Elder and Disability Law Symposium was held on September 29, 2015 at the New Jersey Law Center in New Brunswick, NJ. As in past years, I presented the case law update at the opening plenary session. This year I presented 30 elder and special needs law cases. Following is a summary of of my.. read more →

Sylvia Fishbein and her husband created the Fishbein Revocable Trust in 1994. In 2005, following Mr. Fishbein’s death, Mrs. Fishbein executed a pour-over will, an advance directive naming her stepdaughter Leslie as her healthcare representative, and a power of attorney naming her nephew Eugene as her agent. In 2011, Mrs. Fishbein fractured her hip and.. read more →

The decedent, William Anton, was survived by his wife, with whom he was in the midst of divorce proceedings, and by his three children. A few weeks before his death, Mr. Anton, along with his son-in-law Keith, met with an estate attorney. After Mr. Anton told the attorney that he did not know where his.. read more →

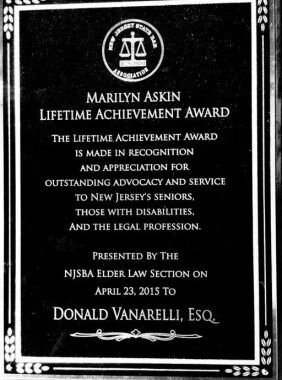

In April of this year, I received the Marilyn Askin Lifetime Achievement Award from the New Jersey State Bar Association’s Elder and Disability Law Section during its annual retreat in Philadelphia, PA. The Lifetime Achievement Award, the Elder and Disability Law Section’s highest honor, is bestowed on an attorney with an established history of distinguished.. read more →

Search

Call Us Today

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media