Increase in Medicaid’s penalty divisor announced. The agency governing the Medicaid program in New Jersey is the New Jersey Department of Human Services, Division of Medical Assistance and Health Services (DMAHS). On March 28, 2023, DMAHS announced an increase in the Medicaid penalty divisor from $374.39 to $384.57 per day, amounting to $11,697.34 per month,.. read more →

Special needs trusts (SNTs), also referred to as supplemental benefits trusts, often play an important role in helping families plan for children with special needs. SNTs allow assets to be left to a disabled or chronically ill person without disqualifying them for public benefits based on financial need, such as Medicaid. A common asset often left.. read more →

The asset limit for Supplemental Security Income (SSI) has been stuck at $2,000 since 1984. That’s equivalent to more than $5,600 today. So, in effect, it has been cut by almost two thirds. There is now a bill in congress, the SSI Savings Penalty Elimination Act that would raise the asset limit to $10,000 for.. read more →

Today, the IRS announced that the annual gift exclusion will rise to $16,000 for calendar year 2022. The amount an individual can gift to any person without filing a gift tax return has remained at $15,000 since 2018. In addition, the basic estate tax exclusion amount for the estates of decedents dying during calendar year.. read more →

Recently, CMS Issued New Guidance for Unrestricted Visitation in Nursing Homes During the COVID-19 Public Health Emergency Nursing homes have been severely impacted by COVID-19, with outbreaks causing high rates of infection and death. In March 2020, the Centers for Medicare & Medicaid Services (CMS) issued a memorandum providing guidance to facilities on restricting visitation.. read more →

The New Jersey Supreme Court has amended the Court Rules governing guardianships to establish a new state-wide policy for background screenings of proposed guardians of incapacitated persons. The amendments are effective as of May 15, 2021. The new policy is intended to safeguard the vulnerable population of incapacitated adults against risks of potential abuse, neglect,.. read more →

Increase in Medicaid’s penalty divisor announced. Last month, the New Jersey Division of Medical Assistance and Health Services (DMAHS), the State Medicaid agency, announced an increase in the state penalty divisor. Effective April 1, 2021, the penalty divisor has increased from $357.67 to $361.20 per day, amounting to $10,986.50 per month and $131,838 per year… read more →

The Centers for Disease Control and Prevention (CDC) has published new guidance for day centers and the people with disabilities they serve during the ongoing COVID-19 pandemic. The guidance comes in two documents — one aimed at administrators and staff and another for participants and their caregivers — that were issued in March 2021. The new guidance indicates.. read more →

The Internal Revenue Service (IRS) has announced that the tax deduction for medical expenses includes amounts spent on face masks, hand sanitizer, sanitizing wipes and related equipment, as long as the primary purpose for the purchase was to prevent the spread of COVID-19. Specially, the IRS announcement states that: [A]mounts paid for personal protective equipment,.. read more →

All Veterans, their spouses and caregivers can get COVID-19 vaccinations from the Department of Veterans Affairs (VA) under Public Law No: 117-4 (03/24/2021), also known as the Strengthening and Amplifying Vaccination Efforts to Locally Immunize All Veterans and Every Spouse Act or the “SAVE LIVES Act.” The SAVE LIVES Act was signed into law by.. read more →

This week, the Centers for Medicare & Medicaid Services (CMS) published revised guidelines for nursing home visits during the pandemic. The new recommendations are the first revision to the federal government’s nursing home guidance since September 2020. They are effective immediately. The new recommendations allow indoor and outdoor visits for all residents, except in limited.. read more →

Under Section 728 of Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (TURCA), federal tax refunds received after December 31, 2009 are not treated as income or resources (for a period of 12 months after receipt) for purposes of determining eligibility for all federal or federally-assisted programs, including Medicaid and the Children’s.. read more →

Under COVID-19 legislation, a one-time direct payment of $1,200 was paid to individuals earning less than $75,000 per year ($150,000 for couples who file jointly), including beneficiaries of Social Security and Supplemental Security Income (SSI) benefits, Medicaid benefits and other public benefits based upon financial need. Individuals earning up to $99,000 ($198,000 for joint filers).. read more →

On December 1, 2020, Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) presented at the 22nd Annual Elder and Disability Law Symposium held via ZOOM Webinar by the New Jersey State Bar Association Elder and Disability Law Section and the New Jersey Institute for Continuing Legal Education. Mr. Vanarelli spoke on planning to attain eligibility for pension benefits.. read more →

Lawyers who claimed that former clients posted false, misleading, and/or inaccurate statements about the lawyer on online reviews asked the Attorney Ethics Board, formally known as the New Jersey Advisory Committee on Professional Ethics (NJACPE), whether they may publicly respond to these negative online reviews. In response, the Attorney Ethics Board stated that lawyers are.. read more →

Tax Benefit Checklist for Families Caring for Special Needs Children Unique tax benefits are available to families with individuals who have special needs. A checklist compiled by Thomas M. Brinker, Jr., a professor of accounting at Arcadia University in Pennsylvania, of some potential tax benefits that could be available to families who care for a special.. read more →

The estate tax is a tax on your right to transfer property at your death. The estate tax is computed based on the value of everything you own or have an interest in at the time of your death. In contrast, the federal gift tax is payable if you give someone money or property during.. read more →

IRS Issues Final Regulations For Achieving A Better Life Experience (ABLE) Accounts

The Internal Revenue Service issued final regulations this month providing details about how Achieving a Better Life Experience (ABLE) accounts should operate. ABLE accounts are designed to help people with disabilities and their families save up to $100,000 without risking eligibility for Supplemental Security Income (SSI) and other government benefits based on financial need. Medicaid can.. read more →

New York was the only state that didn’t have a look-back period for Medicaid home care, but that is now changing. New York Medicaid applicants will no longer be eligible for home care if they gave away assets within 30 months of applying. Medicaid, unlike Medicare, is a public benefit program based upon financial need,.. read more →

A federal court awarded surviving spouse benefits to the surviving partner of a same-sex couple who were prohibited from marrying because of now-unconstitutional state law that banned same-sex marriage. Thornton v. Commissioner of Social Security, Case No. C18-1409JLR, (U.S. District Court, Western District of Washington, September 11, 2020) Helen Josephine Thornton and her partner, Margery.. read more →

The Strengthening Protections for Social Security Beneficiaries Act of 2018 (Strengthening Protections Act) amended the Social Security Act to allow for the advance designation of representative payees for recipients of Social Security and other governmental benefits. The Strengthening Protections Act requires the Social Security Administration (SSA) to promulgate regulations specifying the information Social Security beneficiaries.. read more →

With the coronavirus pandemic responsible for more than a hundred thousand deaths and disrupting life across the United States, the only way for the country to return to normal is an effective vaccine. When a vaccine is available, Medicare will cover the cost. Medicare covers vaccines in a variety of ways, depending on the vaccine… read more →

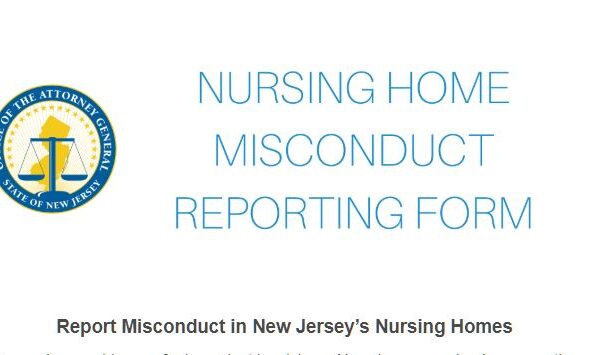

Do you have evidence of misconduct involving a New Jersey nursing home or other long-term care facility during the COVID-19 outbreak? Now you have a chance to report the misconduct to New Jersey’s Attorney General. On April 16, 2020, New Jersey Attorney General Gurbir S. Grewal announced that the Office of the Attorney General had opened.. read more →

On June 5, 2020, the Administrative Office of the Courts issued Directive #18-20, allowing trial courts in New Jersey to enter a judgment granting a divorce in default and uncontested cases on the papers without requiring the parties to appear personally before the court. Judges have discretion to schedule hearings in such matters if necessary.. read more →

The Centers for Medicare & Medicaid Services (CMS) announced new guidance for state and local officials to ensure the safe reopening of nursing homes across the country. The guidance details critical steps nursing homes and communities should take prior to relaxing restrictions implemented to prevent the spread of COVID-19, including rigorous infection prevention and control, adequate.. read more →

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media