The amount that people with disabilities can deposit in an ABLE account each year without jeopardizing eligibility for needs-based governmental benefits will rise from the current $14,000 to $15,000 starting in 2018. Under the law, total annual deposits to ABLE accounts are limited to the federal gift tax exclusion limit set by the IRS. The.. read more →

After being sued by Medicaid applicant in federal court, the Director of New Jersey Medicaid, who had previously denied benefits because the applicant transferred assets to a trust more than 5 years before, instead stated the application was denied because, under the terms of the trust, the trustee was permitted to pay the applicant’s rent… read more →

E.H. submitted a Medicaid application to the Hudson County Division of Welfare (HCDW) and designated Future Care Consultants (FCC) as her designated authorized representative (DAR). Shortly thereafter, the HCDW denied the application because E.H. failed to provide her husband’s bank records for the five-year look-back period. FCC appealed the denial, submitting a request for a.. read more →

Contrary to the recent decision in the G.V. v. Division of Medical Assistance and Health Services case which held that assets transferred to an Income Only Trust more than 5 years before a Medicaid application was filed were still available, rendering the applicant ineligible for benefits, the M.K. v. Morris County Board of Social Services.. read more →

Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 2017 Elder Law College given by the New Jersey Institute for Continuing Legal Education on December 14, 2017 at the Crowne Plaza, located at 690 Route 46 East, Fairfield, New Jersey. Mr. Vanarelli will provide an overview of the new laws governing guardianships in New Jersey.. read more →

The 19th Annual Elder and Disability Law Symposium was held on November 9, 2017 at the New Jersey Law Center in New Brunswick, NJ. As in past years, I presented the case law update at the opening plenary session. This year I summarized 40 elder and disability law cases decided from September 2016 through August.. read more →

Lawsuit for Unpaid Bills by Nursing Home Against Resident’s Power of Attorney Dismissed, and Attorneys Fees Awarded

A Superior Court judge in Ocean County dismissed a lawsuit filed by a nursing home for unpaid bills against a power of attorney appointed by a former resident, and ordered the nursing home to pay legal fees incurred by the power of attorney, ruling that the law prohibited the nursing home from requiring the power.. read more →

The plaintiffs in this case were sisters Ashley Nelson-Guedez and Lyndsay Nelson-Nugent, whose father died in 2007. The plaintiffs’ father, Paul Nelson, predeceased their grandfather. Upon their grandfather’s death, his estate was probated in New Jersey, and Paul’s current wife (Jacqueline Limoli) received Paul’s share of Paul’s father’s estate. Plaintiffs alleged that Jacqueline agreed to.. read more →

The House Republicans tax proposal introduced today ends the Medical Expense Deduction. This change will cause major harm to individuals and families trying to pay for the catastrophic costs of long-term services and supports (LTSS). About half (52%) of Americans turning 65 today will develop a condition that requires LTSS. Individuals needing LTSS are those.. read more →

After being denied Medicaid because of a $70,000 joint bank account she maintained with her son, the Medicaid applicant, S.M., appealed the case to An administrative hearing. S.M. argued that Medicaid had failed to consider that her son was the sole source of $60,000 of those bank funds. After the ALJ affirmed Medicaid’s denial, and.. read more →

The Genworth Cost of Care Survey has been the foundation for long term care planning since 2004. Knowing the costs of different types of care – whether the care is provided at home or in a facility – can help you plan for these expenses. According to Genworth, the 2017 survey is one of the.. read more →

On October 14, 2017, the New Jersey Institute for Continuing Legal Education, Middlesex County Bar Foundation and NJSBA Military Law and Veterans’ Affairs Section presented the 2017 Military Law Symposium at Cook College Student Center, Rutgers University. The Military Law Symposium is presented annually. This year, over 200 current members of the armed forces, veterans.. read more →

Following the death of James E. Mellodge, his youngest child, Joyce Sealtiel, was appointed as his executrix. In the first probate action, the decedent’s oldest daughter, Joan Bozan, sued Joyce, claiming that Joyce unduly influenced their father to name Joyce as the beneficiary of certain POD accounts. A two-day trial was held and the complaint.. read more →

The decedent, Dr. Evan Merritt London, was single with no children. He executed a number of wills and trusts over the years, with the trusts as the primary vehicle for disposing of his estate. He would make periodic trust revisions in which his beneficiaries (including his niece and nephew, his best friend, and various charities).. read more →

2017 Elder and Disability Law Symposium ‘Elder and Disability Law Update’ to be presented by leading NJ Elder Law and Estate Planning Attorney, Donald D. Vanarelli, Esq. Westfield, NJ – October 15, 2015 — Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will participate in the New Jersey Institute for Continuing Legal Education’s 20th Annual Elder and Disability.. read more →

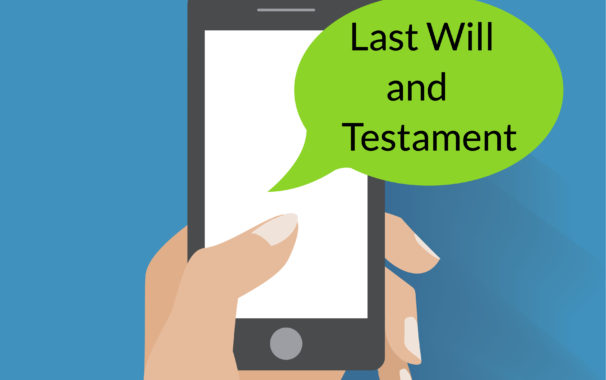

A court in Australia accepted an unsent, draft text message on a mobile phone as an official Last Will and Testament. Nichol v. Nichol The decedent, Mark Nichol, a 55 year old man, committed suicide in 2016. The decedent’s mobile phone was found on a work bench in the shed where the deceased’s body was found.. read more →

Dolores Pierce died in December 2014. She appointed her son Michael as executor of her estate, and letters testamentary issued on May 20, 2015. The decedent’s estate included 3 parcels of real property: a farm, a house (the “Pine Tree” property), and a third property where Michael lived and worked (the “Ramshorn” property). The decedent’s.. read more →

The New Jersey Institute for Continuing Legal Education, Middlesex County Bar Foundation and NJSBA Military Law and Veterans’ Affairs Section will present the 2017 Military Law Symposium at Cook College Student Center, Rutgers University on Saturday, October 14, 2017. This annual seminar is designed for current members of the armed forces, veterans and anyone interested.. read more →

In this will contest, plaintiffs were named as residuary beneficiaries in the Last Will and Testament which the decedent, Charles W. Winter, Jr., executed in 1999. Plaintiffs were all cousins of the decedent. The three defendants also shared close personal and/or family relationships with the decedent. In a new Last Will and Testament executed on.. read more →

Maria Delores Heller was in her seventies and suffering from late-stage ALS. She required round-the-clock medical care and was bedridden. Her late husband’s former legal associate, a New York attorney, filed an Order to Show Cause in New Jersey, seeking to be appointed as Ms. Heller’s guardian. The guardianship application was supported by two doctors’.. read more →

On September 13, 2017, Governor Christie signed legislation known as the “Uniform Fiduciary Access to Digital Assets Act.” In doing so, New Jersey joined 23 other states which have already have enacted a version of the law. The new law recognizes a fiduciary’s right to control a decedent’s digital assets. Under the new law, a.. read more →

A New Jersey appeals court held that a Medicaid application was properly denied when the applicant did not submit all the financial information and documents requested by the Medicaid agency. P.N. v. Division of Medical Assistance and Health Services (N.J. Super. Ct., App. Div., No. A-2025-15T2, July 28, 2017). P.N. resided in an assisted-living facility. Based.. read more →

The Achieving a Better Life Experience Act of 2014 (the ABLE Act) enables individuals with disabilities to save money in a tax-exempt account (ABLE account) which can use for meeting disability-related needs with no impact on eligibility for public benefits based upon financial need. The law states that ABLE accounts should “supplement, but not supplant”.. read more →

In 2005, Stuart and Phyllis Rauch purchased a nursing home facility through an LLC they formed. Their son Eric convinced them to hire his wife, Shan Chin, as a bookkeeper. The business suffered financial losses; by 2008, its net losses exceeded $585,000. In 2009, after losing his job at a law firm, Eric approached his.. read more →

Plaintiff Christopher Hermanns had been an adjunct college professor. He claimed that he quit his job at his father’s request to work in his father’s linen rental business (the “Company”). His father was the sole shareholder of the business, although plaintiff served as the president for six years. According to plaintiff, during his years of.. read more →

As many hospital patients have discovered, there are huge financial implications when a hospital designates one of its patients as an outpatient on “observation status.” In order to receive Medicare coverage for a subsequent nursing home stay, Medicare requires that the patient first have a three-day inpatient stay. The “observation status” designation is an outpatient.. read more →

On August 10, 2017, I presented at the 2017 Sophisticated Elder Law Program on Medicaid litigation strategies. I provided an overview of various strategies and tactics which have been used successfully in litigation involving Medicaid and other needs-based public benefits in state and federal courts and in administrative agencies. I prepared a paper and PowerPoint slides.. read more →

Nursing home resident Joseph Gamma died after falling off his bed at the facility. His estate sued the nursing home. One of the claims the estate asserted was that the nursing home had violated the New Jersey Nursing Home Responsibilities and Residents’ Right Act (“the Nursing Home Act”). At the conclusion of the trial, the.. read more →

Applying New Jersey’s filial support law, an appeals court in Pennsylvania affirmed a decision denying a Pennsylvania residential facility’s effort to hold the elderly New Jersey parents of an adult resident liable for the unpaid balance of his specialized services. Melmark v. Schutt (Pa. Super., No. 2253 EDA 2016, July 19, 2017). New Jersey resident Alexander (Alex).. read more →

In the Matter of the Estate of Anna Fabics involved multiple lawsuits, motions, and other pleadings filed by the decedent’s son Joseph against Joseph’s brother Laszlo. Their mother’s will left her residuary estate to her two sons equally, and appointed Laszlo as executor. The will directed the executor to sell all property of the estate.. read more →

A U.S. district court ruled that a group of Medicaid applicants do not have a private right of action to sue the state for not issuing Medicaid eligibility determinations with 45 days and that the applicants were not denied due process by the delay. Evangelical Lutheran Good Samaritan Society, Inc. v. Randol (U.S. Dist. Ct., D… read more →

Following Alice Malsberger’s death, her niece by marriage, Patricia White (the plaintiff in this lawsuit) found a handwritten document in Alice’s kitchen. It read: I’m Alice Malsberger – I wish to be cremated upon my death – along with my husband Joe – our ashes placed in a similar (illegible) and placed in mausoleum. I.. read more →

Medicaid is a joint federal and state program created under Title XIX of the Social Security Act of 1965. It provides a source of funding for long-term care to those aged, blind and disabled individuals who qualify financially. 42 U.S.C. §1396 et seq.; N.J.A.C. 10:71-1 et seq. Eligibility for Medicaid is based upon financial need. For.. read more →

In this case, the Division of Medical Assistance and Health Services (DMAHS), New Jersey’s state Medicaid agency, affirmed the denial of a Medicaid application filed by Grace M. Vinci (G.V.) by the Monmouth County Division of Social Services (MCDSS) finding that G.V. had resources in excess of $2,000 available to her, namely, resources contained in.. read more →

The United States Court of Appeals for the Third Circuit has ruled that a New Jersey attorney is liable for damages for using undue influence to take $391,000 from an elderly relative. Jane Adkins sued her brother, New Jersey attorney John Sogliuzzo, in federal court, claiming that her brother misappropriated assets belonging to Mary Grimley, their mother’s.. read more →

Search

Call Us Today

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media