Upcoming Presentation on Special Needs Planning and Special Needs Trusts for Community Access Unlimited

Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will provide an overview of the use of Special Needs Trusts (SNTs) by disabled persons so as to prevent an applicant’s financial assets and income from impacting eligibility for needs-based public benefits such as Supplemental Security Income (SSI), Medicaid, services from the Division of Developmental Disabilities (DDD), Section 8 Housing and.. read more →

Some states make it harder for those caring for an aging parent, according to a new survey by Caring.com. While some states were praised for providing an affordable and helpful environment for caregivers, other states ended up at the bottom of the affordability list. “It hasn’t always been so expensive, but the cost of caring.. read more →

Edna M. Fone, a widow, had two children, Richard J. Fone, Jr. and Katherine Fone. Following Edna’s death, Richard sought to probate a 2009 Will allegedly signed by Edna which omitted Katherine as a beneficiary. In response, Katherine filed a lawsuit, seeking to invalidate the purported Will, alleging Richard had exerted undue influence over their.. read more →

I came across the 2018 version of a Social Security Administration (SSA) publication below. Not only has the agency updated the publication to include Special Needs Trusts, but SSA added information about Achieving a Better Life Experience (ABLE) accounts as well. And the agency included hyperlinks to other helpful information. This may assist applicants with.. read more →

The American Bar Association Standing Committee on Ethics and Professional Responsibility recently issued Formal Opinion 480 which opines on the ethics of lawyers blogging and comment on social media. Formal Opinion 480, entitled “Confidentiality Obligations for Lawyer Blogging and Other Public Commentary,” applies existing ethical rules to new online publications such as lawyer blogs. Excerpts.. read more →

What is Elder Law? Elder Law is broad legal practice area involving the problems of older and disabled persons. Elder Law includes counseling and dispute resolution in a variety of areas including health and long-term care planning, identifying and accessing sources of financing for long-term medical care, nursing home issues, qualifying for Medicare, Medicaid and.. read more →

A.M. appealed a gift penalty imposed by the Medicaid agency based on a transfer of assets. The penalty was imposed based on $100,000 in distributions to beneficiaries of an irrevocable trust established by A.M. with her assets. A.M. asserted that the transfer penalty was inappropriate because she established the trust and transferred assets into the.. read more →

Following two days of trial in a probate litigation among the decedent’s children, the parties notified the trial court that it had settled the case. They placed the settlement terms on the record. Those terms included a provision that the parties’ legal fees would be paid by the Estate “following the submission of certifications of.. read more →

Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will facilitate a discussion at the upcoming “Unprogram” presented by the New Jersey Chapter of the National Academy of Elder Law Attorneys on April 25, 2018 at the Wyndham Hotel in the Philadelphia Historic District, 400 Arch St., Philadelphia, PA. The UnProgram is a forum in which elder law practitioners.. read more →

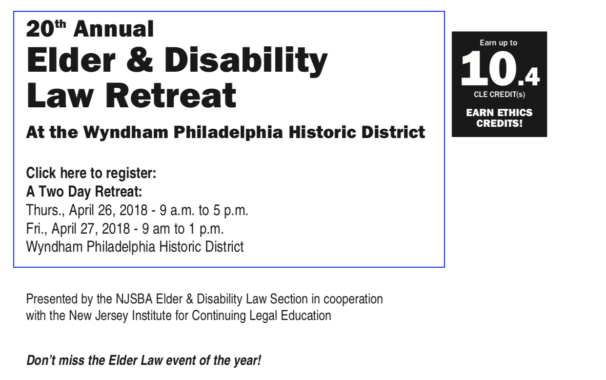

Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 20th Annual Elder and Disability Law 2-Day Retreat to be held on April 26-27, 2018 at the Wyndham Hotel in the Philadelphia Historic District, 400 Arch St., Philadelphia, PA by the New Jersey State Bar Association Elder & Disability Law Section and the New Jersey Institute for.. read more →

Although the decedent had four children, she left her entire estate to two of the children. However, the will did not mention her two omitted daughters, or the fact that they were being omitted. One of the omitted daughters sued, claiming the will was the result of undue influence or lack of testamentary capacity. The.. read more →

The decedent, Alfred Finocchiaro, Sr., died in 2011, predeceased by his wife. The decedent had two sons (Alfred Jr. and Frank) and a daughter. His son Alfred Jr. had predeceased him, having committed suicide on December 29, 2006. The decedent’s daughter survived him, but died before the trial in this case began. The decedent resided.. read more →

Following Joan McBride’s death, her sons from her first marriage asserted claims against her second husband Charlie, who had served as Joan’s power of attorney and executor of her will. Joan and Charlie married in 1997 and remained married until Joan’s death in 2016. The sons claimed Charlie unduly influenced Joan in connection with certain.. read more →

In October 2017, Congress passed an important new law, the Elder Abuse Prevention and Protection Act (EAPPA). The EAPPA is one of very few laws which allocates federal funds to address financial elder abuse. The new law was a direct reaction to increasing incidents of financial elder abuse. Every year, thieves, swindlers and even the.. read more →

Below, in chronological order, is the annual roundup of the top 10 elder law decisions in the U.S. for the year just ended, as measured by the number of “unique page views” of the summary of each case found on the ElderLawAnswers website. ElderLawAnswers is a web-based resource available for those in the public seeking information on.. read more →

D.B., who suffered from schizophrenia, was involuntarily committed to Newton Medical Center’s short-term care facility (“STCF”) after being screened by a psychiatric emergency screening service (“PESS”). He was indigent and he completed an application under New Jersey’s Charity Care Program to cover his hospital bill, but the hospital rejected his application for failure to provide.. read more →

The Department of Veterans Affairs (VA) has emailed the following notice to all accredited attorneys and agents. The notice identifies what the VA calls “recurring problems” with fee agreements between accredited attorneys and agents and the veterans they serve. US Department of Veterans Affairs VA Accreditation: Topics of Interest Hello! This is the first email.. read more →

Named to the Super Lawyers list for twelve (12) consecutive years, 2007 – 2018 Vanarelli & Li, LLC is proud to announce that Donald D. Vanarelli, Esq. has been named to the 2018 Super Lawyers list in Elder Law. This is the 12th consecutive year in which Mr. Vanarelli has been named to the Super Lawyers list.. read more →

Defendant Rosemary Walsh was the executor of the estate of Irene Halpecka, and had been agent under Ms. Halpecka’s power of attorney. Along with the plaintiffs, Walsh was also named as a residuary beneficiary of the estate. Following Halpecka’s death, plaintiffs sued Walsh, alleging breach of fiduciary duty and undue influence in her actions as.. read more →

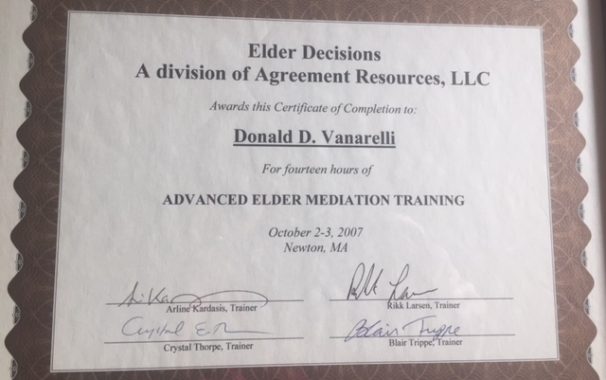

Vanarelli & Li, LLC provides elder mediation services, a specialized form of mediation to help elders, the disabled and their families resolve conflict. Mr. Vanarelli is co-founder of the Elder Mediation Center of New Jersey, a collaborative venture with other elder law attorneys and geriatric professionals whose mission is to educate professionals and private individuals on the.. read more →

Donald D. Vanarelli, Esq., who has focused in planning for the elderly, disabled, and people with special needs for over 30 years, has been board-certified as an Elder Law attorney since 1998. What is Elder Law? Elder Law is a legal specialty focusing on the special needs and legal problems of seniors, the disabled and.. read more →

Although it is common practice to add the name of a family member to a bank account as a convenience, the existence of a “convenience” account can have negative results when that family member applies for Medicaid benefits. In F.J. v. Division of Medical Assistance and Health Services, the applicant’s daughter testified that she opened.. read more →

A New Jersey appeals court upheld the denial of Medicaid benefits to an applicant who failed to provide necessary verifications, rejecting the claim that the Medicaid agency’s failure to assist with the application prejudiced the applicant. P.B. v. Division of Medical Assistance and Health Services (N.J. Super. Ct., App. Div., No. A-5405-15T2, Dec. 8, 2017). P.B.’s daughter.. read more →

Before Mr. Trotman was admitted to a nursing home, he resided in a home that he owned. He had difficulty maintaining the home and paying the bills, so his daughter began paying his bills in 2007. In December 2011, Mr. Trotman asked his daughter to assume full responsibility for the property, which then was also.. read more →

Happy Holidays to clients, supporters, friends and readers. Listed below are the ten (10) eleven (11) posts on the Vanarelli Law Office blog with the highest readership in 2017. After each hyperlinked blog post title, the original post date is included. Check out the list to see this year’s highlights. Our sincere thanks for taking.. read more →

Louis Acerra, the decedent, died at the age of 30 from injuries he suffered in a house fire. He survived more than two years after the fire before finally succumbing to those injuries. During those two years, he was cared for by Richard Litwin. Litwin had been in a relationship with the decedent’s mother when.. read more →

From Our Entire Team, We Wish You, Your Family and Friends a Joyous Holiday Filled with Peace, Love, and Prosperity. Best Wishes for a Healthy and Happy New Year! * ♫ * ♫ * ♫ * ♫ * ♫ * We Also Wish to Express Gratitude to Our Wonderful Community of Clients and Cooperative Professionals. We.. read more →

Ohio’s highest court suspended an attorney who advised his client to transfer assets in order to qualify for Medicaid and then lied to the state Medicaid agency about whether the client transferred assets. Stark County Bar Association v. Buttacavoli (Ohio, No. 2017-Ohio-8857, Dec. 7, 2017). Attorney Glen Buttacavoli’s law practice consisted of providing financial-planning advice.. read more →

This appeal concerned the trial court’s ruling that a 2013 deed was valid. The appellants, who were appointed co-executors of the decedent’s will, claimed that the deed was the product of undue influence. The decedent had owned a condominium and, in 2012, she executed a deed conveying that interest to herself and her niece, as.. read more →

Payments for Pre-eligibility Medical Expenses (PEME) are available to individuals eligible for Medicaid who reside in a nursing home (NH) or an assisted living facility (ALF). This blog post attempts to clarify the procedure for processing requests for payments of PEME made by or on behalf of residents of NHs and ALFs. Residents of NHs.. read more →

Frequently Asked Questions and Answers Who Can Help Me Fill Out the Forms? Any non-accredited individual may assist with completing the forms; however, this individual is allowed to assist ONLY one person. A VA accredited organization, such as your local State Veterans Office, VFW, or American Legion, etc. may help you, as well as an.. read more →

Plaintiff, a son of the decedent, filed a complaint in the Superior Court, Chancery Division, challenging the validity of the decedent’s will. A hearing in the matter was scheduled for June 2015, but plaintiff was unable to obtain a visa to come to the United States for the hearing. The hearing was postponed four times… read more →

Many public benefit programs are adjusted annually after receiving a cost-of-living, or COLA, increase. Following are the increased benefit amounts of selected public benefit programs Including the 2018 COLA adjustment. Social Security There will be a 2.0% COLA increase for Social Security benefits. Maximum Social Security benefit for a single individual retiring at full retirement.. read more →

The Centers for Medicare and Medicaid Services (CMS) has released its Spousal Impoverishment Standards for 2018. The official spousal impoverishment allowances for 2018 are as follows: Community Spouse Resource Allowance The “community spouse resource allowance” is a protection provided under Medicaid law for the healthy spouse of an applicant for benefits (called the “community spouse”) to.. read more →

General Qualifications for VA Non-Service Connected Pension Benefits Plus Aid and Attendance Supplement Veteran, Widowed Spouse and Dependent or Disabled Child (Any May be a Claimant) Veterans Must Typically Have Served Ninety Days Active Duty with One Day During Wartime (Those Who Enlisted After September 7, 1980 Have Additional Time Requirements) Veteran Cannot Have Had.. read more →

Search

Call Us Today

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media