A federal court awarded surviving spouse benefits to the surviving partner of a same-sex couple who were prohibited from marrying because of now-unconstitutional state law that banned same-sex marriage. Thornton v. Commissioner of Social Security, Case No. C18-1409JLR, (U.S. District Court, Western District of Washington, September 11, 2020) Helen Josephine Thornton and her partner, Margery.. read more →

During the COVID 19 crisis, Union County Clerk Joanne Rajoppi has taken several initiatives in light of the challenges presented by the coronavirus. Union County is deeply concerned about the safety of voters and well as their democratic right to vote. As a result, Union County Clerk Joanne Rajoppi has released a video with step-by-.. read more →

Judgment Against Adult Child Who Served As Her Mother’s Power Of Attorney And Executrix Affirmed On Appeal

Christine D. Cenaffra (decedent) had six children, two of whom were the parties in this lawsuit. Diane Cenaffra was the plaintiff, and her sister Patricia Stollenmaier was the defendant. Decedent died in 2015. Her Last Will and Testament named defendant as the executrix. Defendant also was her mother’s power of attorney (POA). Decedent resided with.. read more →

The Strengthening Protections for Social Security Beneficiaries Act of 2018 (Strengthening Protections Act) amended the Social Security Act to allow for the advance designation of representative payees for recipients of Social Security and other governmental benefits. The Strengthening Protections Act requires the Social Security Administration (SSA) to promulgate regulations specifying the information Social Security beneficiaries.. read more →

To help today’s Medicare beneficiaries, the Center for Medicare and Medicaid Services (CMS) combined eight Compare tools, allowing users to easily find information that is most important in making health care decisions. The new platform is currently up and running. Using the new Care Compare Tool, CMS combined 8 original provider Compare websites. In the.. read more →

In this case, the New Jersey Superior Court, Appellate Division, (1) restricted a guardian’s ability to make gifts to those individuals expressly named as residuary beneficiaries of the ward’s Last Will and Testament; (2) limited the amount of gifts to $14,000 per person each year pursuant to a power of attorney which the ward executed.. read more →

The United States Court of Appeals for the Federal Circuit held that the widow of veteran was not eligible for VA compensation and death benefits because veteran received a dishonorable discharge. Garvey v. Wilkie (Court of Appeals Federal Circuit 08/28/2020) John P. Garvey served in the Army from 1966 to 1970. After training, Garvey was.. read more →

Press Release Thursday, September 3, 2020 Mark Hinkle, Acting Press Officer For Immediate Release [email protected] The Social Security Administration announced.. read more →

A federal court dismissed a lawyer’s $1.5 million defamation lawsuit against Avvo, Inc., a website which compiles and maintains an electronic directory of lawyers, for posting a low attorney rating on the internet and false information that negatively impacted the lawyer’s ability to attract new clients. Straw v. Avvo, Inc., 2020 BL 326152, W.D. Wash.,.. read more →

Millions of Americans manage money or property for a loved one who’s unable to pay bills or make financial decisions. To help financial caregivers, the Consumer Financial Protection Bureau, or the CFPB, worked closely with the American Bar Association Commission on Law and Aging to prepare four (4) consumer guides: Help for agents under a.. read more →

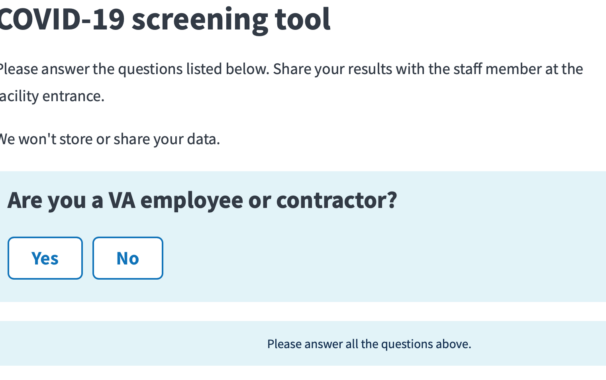

Many VA Medical Centers across the country are re-opening their doors and expanding services. To ensure the protection of both patients and staff, the VA’s Office of Information and Technology launched the COVID-19 digital pre-entry screening tool. The digital pre-entry screening tool allows Veterans, caregivers, and employees to answer questions on their mobile phones and share their.. read more →

The New Jersey Director of Medicaid approved the transfer of an applicant’s home to a “caregiver child” who worked full-time because the applicant qualified medically for comprehensive home-based services under the Medicaid program. A.H. v. Bergen County Board of Social Services, OAL DKT. NO. HMA 09215-19 (June 26, 2020) When she was 92 years old,.. read more →

An Ohio appeals court dismissed a nursing home’s lawsuit to recover a resident’s unpaid fees from his son who signed an admission agreement as his father’s agent under a power of attorney. Village at the Greene v. Smith (Ohio Ct. App., 2d, No. 28762, August 14, 2020). On June 22, 2018, Robert Smith (“the father”) granted.. read more →

Millions of Americans manage money or property for a loved one who’s unable to pay bills or make financial decisions. To help financial caregivers, the Consumer Financial Protection Bureau, or the CFPB, worked closely with the American Bar Association Commission on Law and Aging to prepare four (4) consumer guides: Help for agents under a.. read more →

The New Jersey Appellate Division held that the state Medicaid agency is required to screen a Medicaid recipient for eligibility for all other Medicaid programs before terminating the recipient from the Medicaid program for which the recipient is presently eligible. D.C. v. Div. of Med. Assistance & Health Servs., 2020 WL 4290056 (N.J. Super. Ct… read more →

In a case of first impression, the New Jersey Supreme Court held that forcing a defendant to reveal the passwords to his password-protected iPhones which were properly seized by police authorities does not run afoul of the state or federal constitutions. State v. Robert Andrews, Docket No A-72-18 (NJ Supreme Ct., August 10, 2020). The.. read more →

Planning the long-term future of a child with special needs can be the source of enormous stress for parents. Among the challenges of raising a child with special needs is figuring out how to provide for that child once you’re gone. If the child will never be able to earn a living, how can you determine.. read more →

Based on reports from the police department, Adult Protective Services of Sussex County (APS) opened an investigation into the well-being of then eighty-five-year-old Sally DiNoia, who was living in her home with her adult son, John. Sally’s husband Paul had passed away, and John had been Sally’s primary caregiver for several years. . APS’s investigation.. read more →

In New Jersey, all guardians are appointed by the Superior Court of New Jersey. A “guardian” is a person appointed by a court to make decisions regarding the person or property of an incapacitated adult. A person is “incapacitated” under the law if he or she “is impaired by reason of mental illness or mental.. read more →

Millions of Americans manage money or property for a loved one who’s unable to pay bills or make financial decisions. To help financial caregivers, the Consumer Financial Protection Bureau, or the CFPB, worked closely with the American Bar Association Commission on Law and Aging to prepare four (4) guides: Help for agents under a power.. read more →

Members of the military may qualify for special tax benefits. For instance, they don’t have to pay taxes on some types of income. Special rules could lower the tax they owe or allow them more time to file and pay their federal taxes. Here are some of these special tax benefits: Combat pay exclusion: If.. read more →

With the coronavirus pandemic responsible for more than a hundred thousand deaths and disrupting life across the United States, the only way for the country to return to normal is an effective vaccine. When a vaccine is available, Medicare will cover the cost. Medicare covers vaccines in a variety of ways, depending on the vaccine… read more →

U.S. states offer Veterans a wide range of benefits. State representatives provided the Department of Veterans Affairs (VA) with a list of the most popular benefit available to Veterans in each state. Readers can find the list of the most popular VA benefit in each state on the VA website, here: https://www.blogs.va.gov/VAntage/76439/veterans-benefits-2020-popular-state-benefit/ A description of.. read more →

Many years after her mother’s death, plaintiff filed litigation against her sister’s husband Howard regarding plaintiff’s late mother’s estate. She claimed that Howard had been managing her mother’s money while she was alive and that, upon her mother’s death, Howard continued to manage that money on behalf of plaintiff and her sister. Plaintiff’s complaint against.. read more →

The Social Security Administration (SSA) has asked the National Organization of Social Security Claimants’ Representatives (NOSSCR) to share the following information with NOSSCR members, SSA and SSI disability claimants with pending appeals and other interested parties: Dear Colleague, I want to share an update regarding ways to contact our hearing offices during the Coronavirus (COVID-19).. read more →

The Director of New Jersey’s state Medicaid agency overturned prior decisions to find that, when a Medicaid applicant resides in his or her home, the date on which the applicant is found clinically eligible for Medicaid benefits is the date the Mediciad agency should use in determining financial eligibility. S.W. v. Cumberland County Board of.. read more →

A New Jersey appeals court upheld a Medicaid penalty period imposed on a nursing home resident who, prior to admission, paid home health care aides via checks payable to “cash” without written contract, and didn’t prove that the rates paid to the aides were for fair market value. D.Z. v. Ocean County Board of Social.. read more →

The New Jersey appellate division sustained the denial of Medicaid benefits based upon the applicant’s failure to submit documents necessary to verify his eligibility. Even though the Medicaid applicant was incapacitated due to dementia, could not speak, and whose agent under his power of attorney failed to assist, the court held that the Medicaid agency.. read more →

Donald D. Vanarelli, Esq. (http://VanarelliLaw.com/) will present at the 2020 Elder and Disability Law Retreat to be held virtually via ZOOM on July 30, 2020 by the New Jersey State Bar Association Elder and Disability Law Section and the New Jersey Institute for Continuing Legal Education. Mr. Vanarelli will participate in a panel of attorneys.. read more →

Each year on June 15, the World Elder Abuse Awareness Day is celebrated by sharing resources to help prevent elder financial exploitation. The Consumer Financial Protection Bureau (CFPB), a federal agency, defines “elder financial abuse” as a situation in which “someone uses an older adult’s resources improperly or deprives an older adult of access to,.. read more →

Do you have evidence of misconduct involving a New Jersey nursing home or other long-term care facility during the COVID-19 outbreak? Now you have a chance to report the misconduct to New Jersey’s Attorney General. On April 16, 2020, New Jersey Attorney General Gurbir S. Grewal announced that the Office of the Attorney General had opened.. read more →

The Centers for Medicare & Medicaid Services (CMS) sent a news alert recently recognizing that some nursing homes are seizing residents economic impact payments (or “Stimulus Checks”) authorized under the CARES Act. CMS confirms that this practice is prohibited, and nursing homes that seize these payments from residents could be subject to federal enforcement actions,.. read more →

On June 5, 2020, the Administrative Office of the Courts issued Directive #18-20, allowing trial courts in New Jersey to enter a judgment granting a divorce in default and uncontested cases on the papers without requiring the parties to appear personally before the court. Judges have discretion to schedule hearings in such matters if necessary.. read more →

New Jersey Bankers Association Financial Elder Abuse Webinar Date Time: Jun 10, 2020 10:00 AM Eastern Time (US and Canada) Topic: On-Line Webinar on Financial Elder Abuse Financial Elder Abuse is a growing concern, with 4 million cases of elder abuse reported last year. The elderly are often bilked out of their savings, investments, and.. read more →

Vanarelli & Li, LLC has been working hard to continue serving you during the Coronavirus (COVID-19) crisis. Many clients have limited access to their important planning documents and must create new ones. We have created new processes to assist our clients in a time when we are forced to socially distance ourselves and work in.. read more →

Search

Call Us Today

Categories

- Affordable Care Act

- Alzheimer's Disease

- Arbitration

- Attorney Ethics

- Attorneys Fees

- Beneficiary Designations

- Blog Roundup and Highlights

- Blogs and Blogging

- Care Facilities

- Caregivers

- Cemetery

- Collaborative Family Law

- Conservatorships

- Consumer Fraud

- Contempt

- Contracts

- Defamation

- Developmental Disabilities

- Discovery

- Discrimination Laws

- Doctrine of Probable Intent

- Domestic Violence

- Elder Abuse

- Elder Law

- Elective Share

- End-of-Life Decisions

- Estate Administration

- Estate Litigation

- Estate Planning

- Events

- Family Law

- Fiduciary

- Financial Exploitation of the Elderly

- Funeral

- Future of the Legal Profession

- Geriatric Care Managers

- Governmental or Public Benefit Programs

- Guardianship

- Health Issues

- Housing for the Elderly and Disabled

- In Remembrance

- Insolvent Estates

- Institutional Liens

- Insurance

- Interesting New Cases

- Intestacy

- Law Firm News

- Law Firm Videos

- Law Practice Management / Development

- Lawyers and Lawyering

- Legal Capacity or Competancy

- Legal Malpractice

- Legal Rights of the Disabled

- Liens

- Litigation

- Mediation

- Medicaid Appeals

- Medicaid Applications

- Medicaid Planning

- Annuities

- Care Contracts

- Divorce

- Estate Recovery

- Family Part Non-Dissolution Support Orders

- Gifts

- Life Estates

- Loan repayments

- MMMNA

- Promissory Notes

- Qualified Income Trusts

- Spousal Refusal

- Transfers For Reasons Other Than To Qualify For Medicaid

- Transfers to "Caregiver" Child(ren)

- Transfers to Disabled Adult Children

- Trusts

- Undue Hardship Provision

- Multiple-Party Deposit Account Act

- New Cases

- New Laws

- News Briefs

- Newsletters

- Non-Probate Assets

- Nursing Facility Litigation

- Personal Achievements and Awards

- Personal Injury Lawsuits

- Probate

- Punitive Damages

- Reconsideration

- Retirement Benefits

- Reverse Mortgages

- Section 8 Housing

- Settlement of Litigation

- Social Media

- Special Education

- Special Needs Planning

- Surrogate Decision-Making

- Taxation

- Technology

- Texting

- Top Ten

- Trials

- Trustees

- Uncategorized

- Veterans Benefits

- Web Sites and the Internet

- Webinar

- Writing Intended To Be A Will

Vanarelli & Li, LLC on Social Media